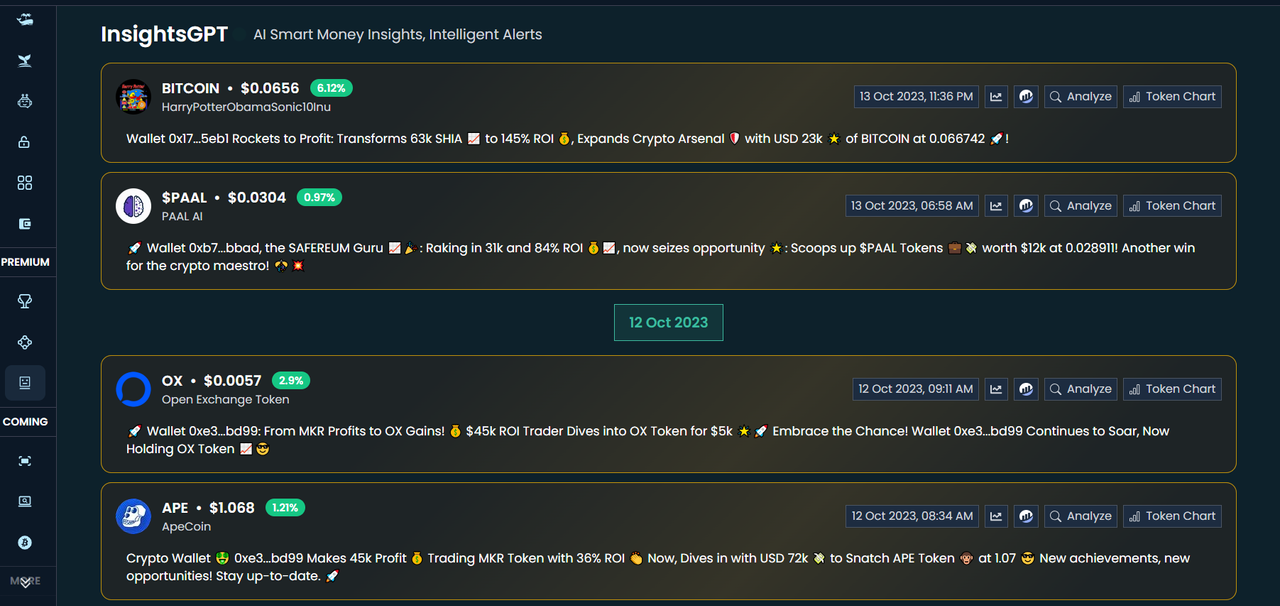

This isn’t even a flex, but, thanks to the profits made from this venture, CryptocurrencyScripts now has a runway of at least, 5 years. I’ve spilled the beans, now we can move on. Even if you have yet to dip your feet into any of the flurry of solana memecoins, you must have heard about one of them. The one Wif a hat or the one about a used Honda 2001 Civic. Really cool memes from each of these projects, but if they are worth the millions…I can’t say for sure. But I know one thing, everyone dabbling into those projects is looking for a Max Wynn…sorry, win. Memcoins are fun, especially when they 10X your ‘investments’, can’t say the same if they -90%ed your investment in one hour. I’ve been in both, I enjoyed the former, the latter was also fun.

After a few months of ‘aping’ into weird projects, I have a diary to share. Not like anyone cares, but even if this doesn’t get to the cabals and the cults, it’s always fun to write on this platform. Just to mention, the next episode of the Snack Talk is also in the works!

I’ll get to it quickly

We are all here for the money!

Yeah, quit the ‘tech’ talks already. It’s obvious, no one is here for the technology. I used to put it at 10%, but it’s actually 0%. Memecoiners are just like everyone else who dabbles their money into a magic internet coin with the hopes of making massive profits, and converting everything to fiat…and buying a Lambo. Only difference is; others play the long game while memecoin connoisseurs play the fast game. Most investors are a hybrid. The random investor will take a quick 100X over ‘a ground-breaking decentralized innovation’. No pun intended, but reality hits hard. The usual 1hr chart for every new memecoin depicts, FOMO, profit taking, and rugpull, in that order. And this is where the fun lives!

Are crypto investors really smart?

Smart investments are preceded by proper research and risk-managed entry. Thing is, memecoins don’t give anyone a chance to do any of these. The boat might be far gone before you get to any of these. It’s the old-fashioned ‘first ape, then research’. If that’s the case, then, are we really smart investors or autistic degenerates who jump into the water without checking the depth? This question is not even a caution or a corrective ponder, just asking if we are still moving in line with the goal of breeding a generation of smarter investors. It is clear why the wizard of Berkshire Hathaway isn’t a fan of anything we are doing here. No problem, he can have his fiat while we have our Bonk!

The Bigger Fool Theory

Remember what you had in mind while buying that memecoin? I can’t read your mind, but somewhere in there, you are convinced that someone will be dumb enough to buy after you and drive the price up. This is not about memecoin only, maybe it is actually a big factor driving the general cryptocurrency gains. A lot of unconvincing crypto projects make it to reasonable heights simply because the next partially convinced investor jumped in with the hope that the dumber money would follow. The pyramid collapses when the next ‘fool’ doesn’t emerge.

Rugpulls are only serious if the project never recovers

Removing liquidity is the old-fashioned way of doing rugpulls. That act already improved and I think the new method is more lucrative. It’s simple and it gives the project a chance of making a recovery if the community takes over and “work for their bags”. Here’s how it goes, create a weird coin, keep a majority percentage, add the rest to the liquidity pool, and dump your bags once buyers come. This way, the initial liquidity remains, you make your money and if the community is strong enough, the project survives and everyone wins…well, not everyone exactly. I’m not telling you how to get away with murder, but this gives the project a chance of surviving and maybe you can get away with your Theft. Yes, theft.

‘Influencers’ are the literal Wolves

You’d ask why UsedCar is sitting at a multimillion-dollar market cap while Panda, an older and similar project on ZkSync is wallowing below the $30,000 market cap. The answer, the influencers didn’t get to it or haven’t gotten to it yet. It’s never a crime to talk about a project you are interested in, but doing it just to lure your followers and dump the tokens you got for free on them is a ‘wolf and Lamb’ parable. For every memecoin that made it to the top, there are tons of influencers using their followers as exit liquidity. Really plausible how they are able to do the luring game, something to learn about marketing there, the end goal is the only negative part. Lots of quality memcoins projects never make it out because they prefer to stick to the community-building goal instead of greasing influencers’ palms. Well, no sympathy here, it’s all a game anyway.

The biggest Fundamental is Shilling

If you want something out of a project you are invested in, the only thing to do is to Shill it. To your friends, your colleagues. Yeah, they are your exit liquidity, but that’s how this thing goes. Bluechip or just a memecoin, the biggest fundamental is Shilling. To put it straight, the project with the most shillers wins.

Ask if I still nurse the idea of gambling on memcoins? The answer is a big Yes, just like anyone else who wishes to test their risk-taking abilities. The essence of this whole rambling is to share my experience, not to announce that I’m leaving the game. Another goal is to ask the big question; “Are we actually investing or Gambling?” The events around these memecoins suggest that this is all a gamble, whichever one, managing risks is recommended. On the outlook, the Rugpulls and investor deception do not paint a good picture of the whole space. But hey, the warnings are everywhere. Memcoins, just like any other crypto investment is a high-risk venture. The thrill is there, the stock market and its 20% annual gains are boring and it’s human to go in search of thrills. Memcoins present that on a platter, it is not clear if this is good or bad.

Follow up with CRYPTOCURRENCY SCRIPTS to stay refreshed in the crypto space with comprehensive articles and important tips.