Numerous articles tip bitcoin and cryptocurrencies over fiat currencies and a couple more insinuating the inferiority of traditional hard currencies and suggesting these currencies might become obsolete and deprecated in the near future. ‘The death of fiat is imminent’ they say, but is this really true? I don’t know what your answer might be, but I strongly doubt if the days of paper currencies are anywhere near an end, especially not with the current state of the crypto space.

Recent trends of countries employing blockchain technology in certain sectors including finance have fueled the trend of people envisioning a world without fiat and a world where currencies running on the blockchain are the generally accepted resource exchange means. But while this is a possibility, it is a very long-term vision and as a matter of fact, stands a very little chance of coming true.

While I am pro-bitcoin and cryptocurrency, the masterpiece of fiat currencies and the current shortcomings of bitcoin and cryptocurrencies are hard to ignore. And according to certain cryptographers, ‘Blockchain is a clever technology but cryptocurrencies are useless’. This is certainly not true to a large extent, but to an extent, it basically expresses dismay at cryptocurrencies. While the technology backing these flexible currencies holds many applications, cryptocurrencies have to a large extent depicted some shortcomings which are very hard to ignore.

Fact is, no system or technology is 100% efficient, but tipping a very young prospect that has displayed some huge level of inefficiency over a system which have served for centuries could be asking too much…and moving too fast.

A little assessment, how well do you think cryptocurrencies will perform as a global means of exchange? Critical thought will reveal numerous issues which may arise from this. While these issues are fixable, cryptocurrencies and blockchain technology are still some miles away from solving these issues.

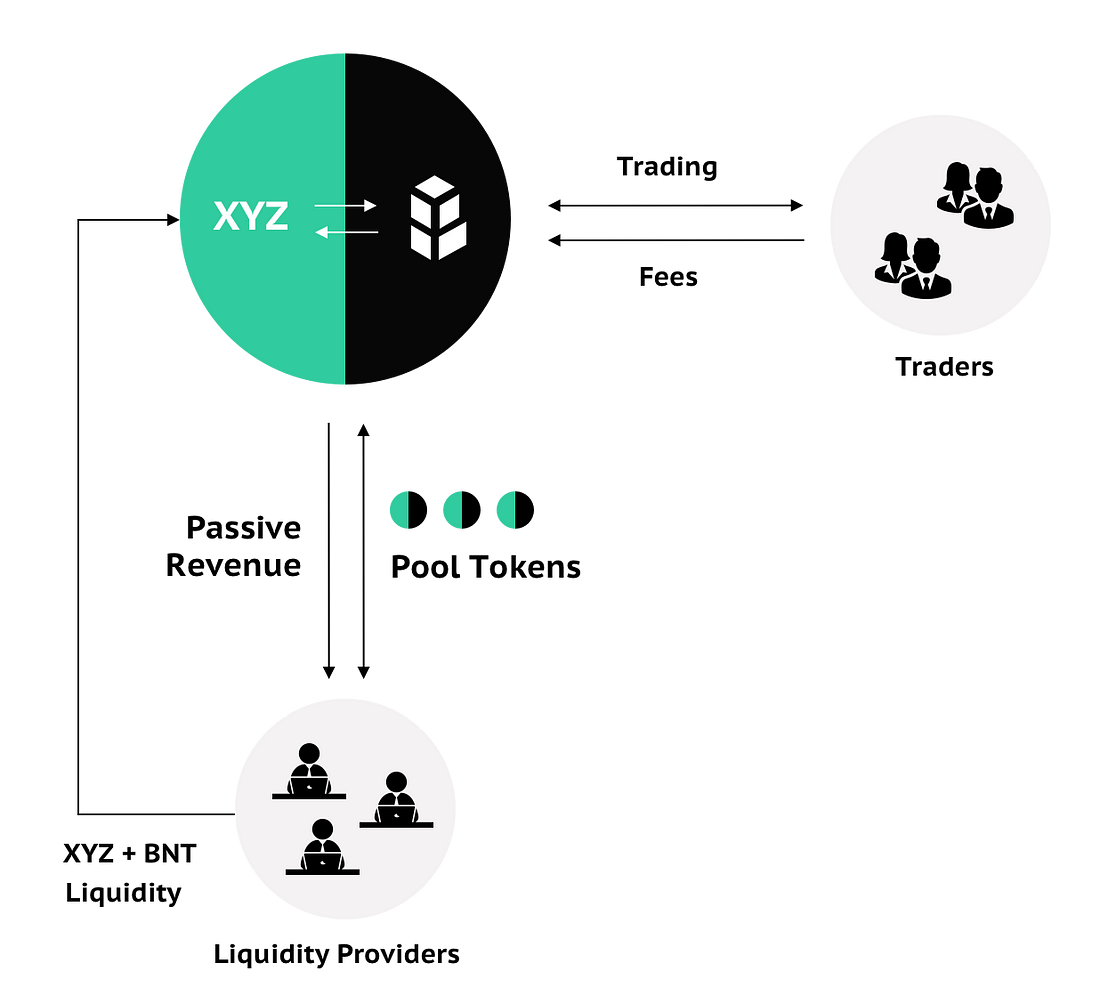

Cryptocurrencies are better off as utility tokens than global currencies used for mainstream exchange. However, if cryptocurrencies must be used for this purpose, then a little bit of centralization must come in, and this defeats the whole goal of decentralization and cutting off the middleman to add security and privacy to the fund transfer process.

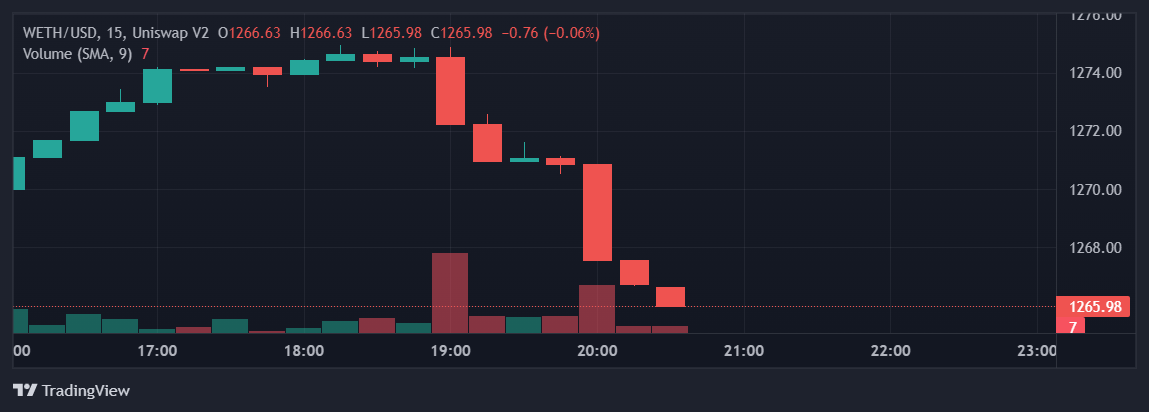

Achieving high throughput in transactions is also a blockchain issue that limits the use of cryptocurrencies in everyday ‘spend’ activities. Optimization of the spend and receive algorithms set a blockchain project ‘a head above others’, while many contemporary blockchains can process the transfer and reception of assets, many users still face tangible constraints while using this feature, this stems from the complicated steps required before a transfer request is made and a slow speed of processing transactions. To serve the people better, an optimized means of spending funds is essential.

Talk about portability. Of course! Present banking financial technologies are focused on providing a portable medium of financial transactions, hence the recent surge of banking applications, bar-code spending systems, and other web-based banking services. This has simplified financial activities and created a sort of ‘digital fiat’ which runs without the blockchain and in a centralized system, but it of course presents a flexible spending system with some regulations which try to monitor the use and block irregular activities…to an extent.

Ok, blockchain claims to be transparent, and this is a fact relative to custodial banking systems, but transparency is just a tool that aids financial regulation, however using a transparent financial system with no means of actually curbing irregularities in the system makes it all futile. If you can see the unscrupulous acts going on but can’t stop or reduce them, then transparency is almost of no use. This is the case in a truly decentralized blockchain-powered financial system.

Currently, cryptocurrency’s universality is the only enticing feature it really has over the current fiat currencies, financial systems, and banks. With the current instability, manipulations, and technological shortcoming, it is as a matter of fact inferior to fiat currencies and the current banking system.

Seeing cryptocurrencies as utility tokens of blockchain projects which solves some real-world problems or presents a new and/or more efficient way of handling real-world issue is probably the healthiest way to look at it. Bringing some aspects of blockchain technology into fintech and revolutionizing the financial system to incorporate some virtues of blockchain technology into the mainstream financial system will surely create a more efficient financial system. The fiat system may never die, but if blockchain technology and cryptocurrencies take a healthier route and fix some of its biggest issues, then they stand a chance of penetrating the mainstream financial system…but not replacing fiat. Replacing fiat with cryptocurrencies is just a long-lasting illusion.