Probably not a popular article to come across in Web3 these days. The focus has shifted to memecoins and flipping coins for ‘quick bucks’. But if the memecoin hysteria ever subsides and retail pays attention to utility projects, 2026 could be a positive year for projects that offer facilities (Onchain infrastructure) for building businesses on the blockchain.

2026 could be the year of onchain infrastructure…optimistically.

Two onchain infrastructure narratives appeal most to me: Internet Capital Markets and the X402 payment protocol.

No pandering, I’ll simply get to it, and in a conversational tone.

Internet Capital Market: Onchain Infrastructure democratizing seed investments for retail

Let me put it this way, crypto is moving away from the usual “bring money, take coin” kind of fundraisers. That, in the past, has mainly benefited Venture capitalists who get in very early and project teams who raise at unreasonable valuations. We’ve seen projects raise hundreds of millions without even building any tangible products.

So retail investors and VCs with lower reach are increasingly pivoting to fair launches through Internet Capital Markets (ICM).

The idea of internet capital markets is to enable anyone to build real value on the internet through fair and transparent funding mechanisms. Internet Capital Markets are built on the nuances of decentralization; bridging everything from fundraisers to platform launches and protocol interactions.

This is relevant to investors because it lowers barriers to participation and increases transparency. ICM projects already have a cumulative valuation of over $380 million, and are projected to grow to hundreds of billions of dollars. A strong candidate for the most influential narrative next year.

Why Internet Capital Markets?

Regular Launchpads serve two purposes: handle user verifications and transfer purchased assets. You’d expect a plain output, but these platforms have a UX issue, thanks to regulatory and accessibility challenges.

In terms of regulation, regular launchpads have little to no influence on how founders set valuations. As a result, founders can raise at an insanely high valuation before even delivering any working prototype. The most telling effect is poor performance after launch and losses for the investor. This was the case with the 2017 ICO boom and many other ICOs, IDOs, and IEOs that followed it.

In addition, regional restrictions and high investment minimums limit retail participation in fundraisers.

Internet capital markets attempt to resolve the limitations of seed investing by reducing known overheads: accessibility and regulation.

For a better understanding of the Internet Capital Market, imagine Nasdaq and Y-Combinator, but then fully permissionless. Activities like project listings, funding contributions, and management of funds generated through fundraisers are handled on-chain.

Internet Capital Markets leverage funding models that decide if a project’s fundamentals are even reasonable enough to be funded. This way, it creates responsible founders. Founders that raise via ICMs can only access the money they got from fundraisers in phases; each phase is defined by specific deliverables that the team must satisfy.

The model is synergized with smart contracts that handle tokenization, custody of funds, and a data management and verification layer for record-keeping, ensuring that every process runs smoothly.

If Internet Capital Markets work as expected, a functional ICM platform allows anyone to own a share of new high-potential projects with very low capital and significantly regulates the fundraising structure for intended launches.

By lowering the barrier to asset issuance and ownership, Internet capital markets open a trove of liquidity and innovation. And this is particularly important for the next stage of crypto and blockchain adoption.

So why is this even a big deal when it’s just another set of launchpads with more ‘gimmicks’?

Understanding the Internet Capital Market Meta

Coinbase acquired Echo from Cobie (Jordan Fish) for $375 million. Echo is a capital market for new launches. Solana’s marketing team is also putting up campaigns for Internet Capital Markets on Wall Street. Pump.fun, launched Spotlight, an ICM protocol, and published a thesis for Internet Capital Markets.

All these are positive for ICM as a crypto narrative. But why the rave?

Well, I wouldn’t be surprised if Internet Capital Market turns out to be another buzzword used to milk retail investors. But from a fair standpoint, it is a brilliant idea.

Imagine being able to bring anything onchain, from ideas to existing companies. Internet Capital Market implies that the internet is capable of creating dynamism between capital and the market.

That is, you can raise capital and run a thriving business whose complete operations are online, instead of just using the internet as a front for a business that is completed offline.

ICMs are important, not only because they will pilot an insane flow of capital, but because they will pioneer an era where everything is moving on-chain through a regulated but permissionless channel.

Projects in this category will provide handy infrastructures for establishing ideas and businesses on-chain. From advanced launchpads and easy tokenization facilities to project advisory.

The idea is this: “We will give you a platform to issue your tokens, raise funds through token sales, and launch your projects successfully. But your capital will be locked and can only be released as you make tangible progress”.

In this last quarter of 2025, we’ve seen a new style of launches. Projects that launch via ICMs now raise at reasonable valuations to give room for growth. Because capital markets hold them responsible.

Apart from crypto natives launching new projects, mainstream institutions that wish to move part or a whole of their business on-chain are definitely going to use ICMs.

ICMs could return the control of the markets to retail, something that previous ICOs, IDOs, and IEOs have failed to do.

Positioning for the Internet Capital Market meta

I followed a few fundraiser events on MetaDAO;

- Umbra

- Avici and

- Omnipair

Among these three projects;

Avici intended to raise $2 million, got $34.2 million in commitments, but only accepted $3.5 million. Umbra, intended to raise $750,000, got $154 million in commitments, but only accepted $3 million.

To date, 6 projects have raised a total of $17.6 million via MetaDAO. MetaDAO introduced the Futarchy model for deciding projects’ funding proposals. The model uses conditional prediction markets; traders bet $META on “Pass” or “Fail” outcomes of proposals. The proposal passes only if the Pass market price exceeds Fail (via TWAP).

A few other ICM platforms exist, but MetaDAO is the most striking yet, in my opinion. DAO Maker, Creator Buddy, and crypto-tradfi tokenization platforms like Backed Finance are other ICM projects you can look up.

A few things to keep in mind for ICM projects are their existing fundraiser records. For investors just trying to make profits from the narrative, ‘numbers’ are simply what to look at. Founders will launch on ICMs that can drive interest to projects, while investors will use platforms that cater to their financial security. These are the primary metrics for ICMs.

Another major onchain infrastructure that could shape crypto in 2026 is X402-powered payment for AI agents.

Agentic payment powered by X402 protocol: infra for AI and AI agents. Driver for Internet Capital Markets

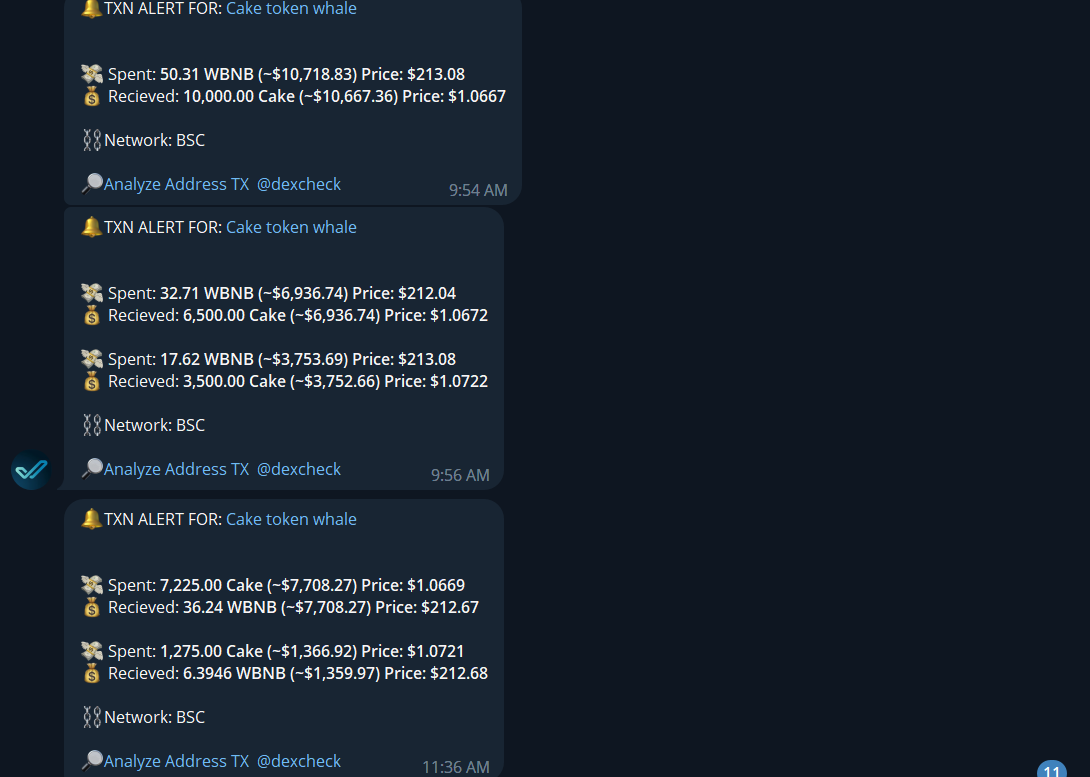

Google and social media search trends for X402 skyrocketed in late October after the Coinbase developer team showcased how they utilize the X402 protocol for its payment MCP (Model Context Protocol).

X402 is an internet-native payment protocol. With X402, AI agents, decentralized protocols, data layers, and APIs can interact autonomously without external interference. In a nutshell, using X402 payment rails, AI agents can pay for data on a pay-per-use basis without middlemen.

Am I excited about X402? Yes. It opens up many possibilities for AI, AI Agents, and Crypto as a whole. For developers, X402 payment rail facilitates building onchain. It offers a seamless payment system for anyone building in AI and DeFi.

X402 ecosystem has grown rapidly, and the cumulative market cap of X402-enabled projects is now about $11 billion, according to Coingecko. This number could be deceiving anyways. A majority of big projects in the category are existing projects like Chainlink and Enjin.

X402 transaction data

According to data from X402 Scan, AI agents have autonomously processed over $24 million via X402 payment rails in the past 30 days, with peaks on November 15 and 18. X402 adoption picked first on Base Network, thanks to Coinbase’s involvement in core development, but the narrative is spreading to other chains, including Solana, Ethereum, and BNB Chain.

I admit it, X402 is mostly hype for now. Many projects in the category are only trying to benefit from the narrative and haven’t built anything significant. But there’s a lot to expect in the future, and the X402 boom is bullish for AI and Internet Capital Markets as well, for many reasons.

First, it is the Internet Capital Market at its best. It enables AI agents to fully run online and onchain without interacting with off-chain resources. Also, it will significantly drive launches as developers build X402 resource systems and projects that utilize the X402 payment rails. Many of these X402 projects will seek funding through ICMs.

Positioning for an Onchian infra meta driven by ICMs and X402

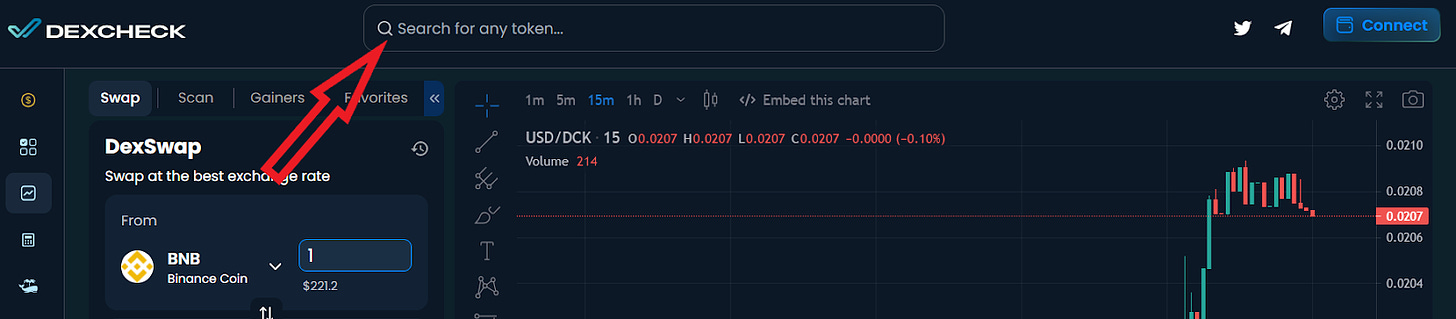

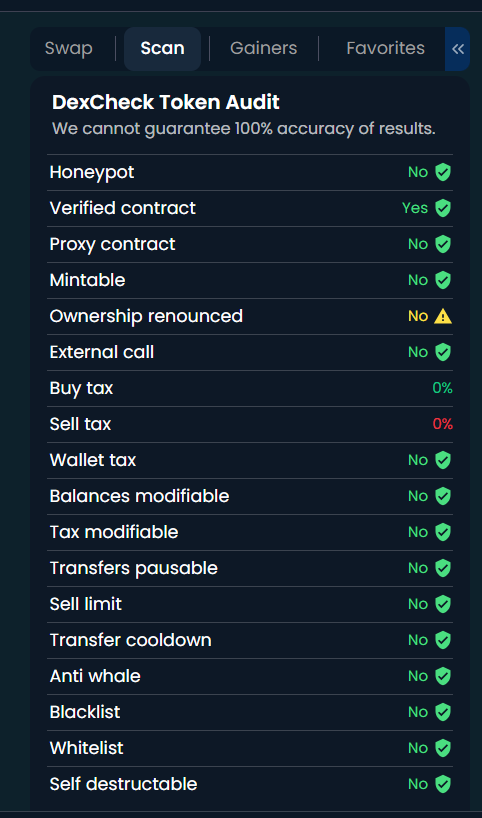

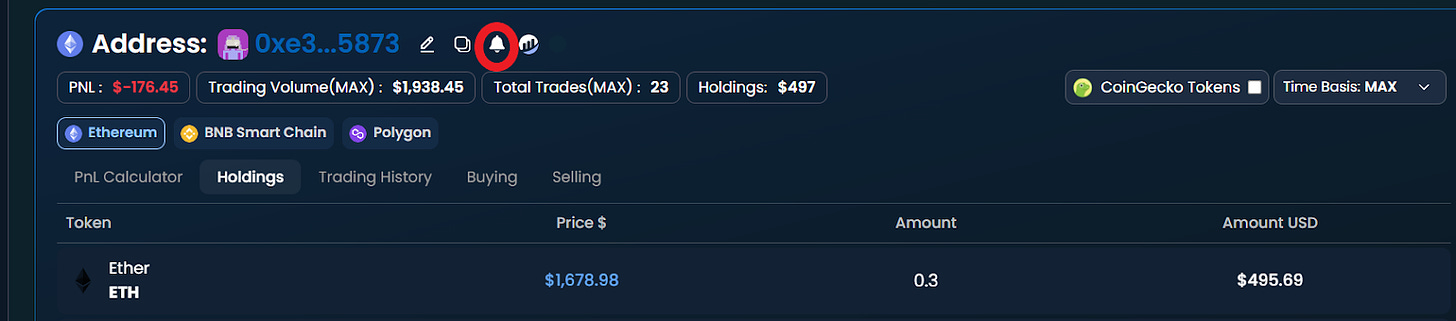

Most relevant X402 projects already have a native token. A good way to position for a possible X402-drive rally is investing in these tokens. However, before investing in any of these, consider the project’s relevance to the meta. In the usual crypto culture, many projects will attempt to extract value from retail investors by building a low-end product with an X402 tag.

NFA, but some promising projects I’ve come across in the X402 category include Daydreams, Dexter, and Heurist.

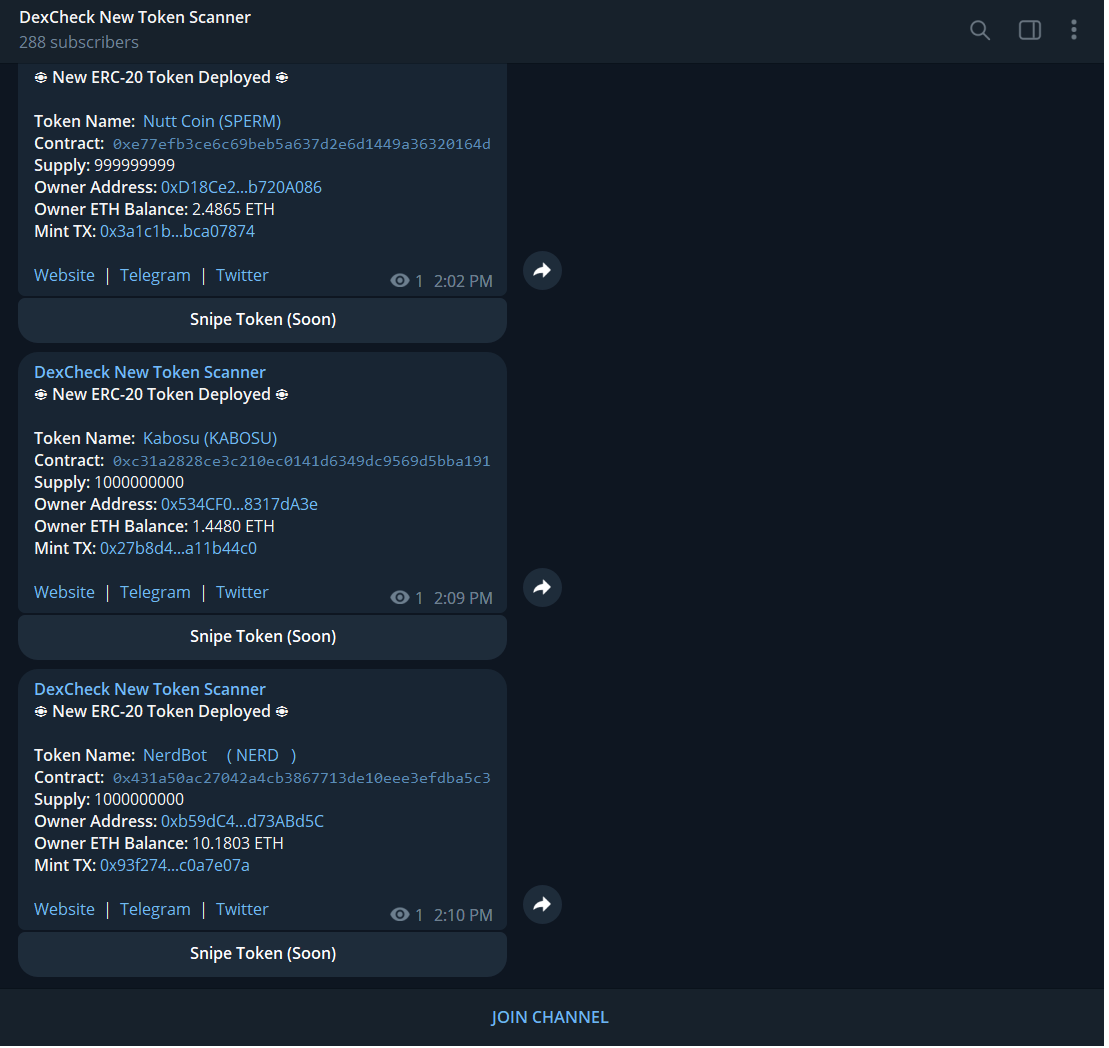

Top X402 agents on X402 scan

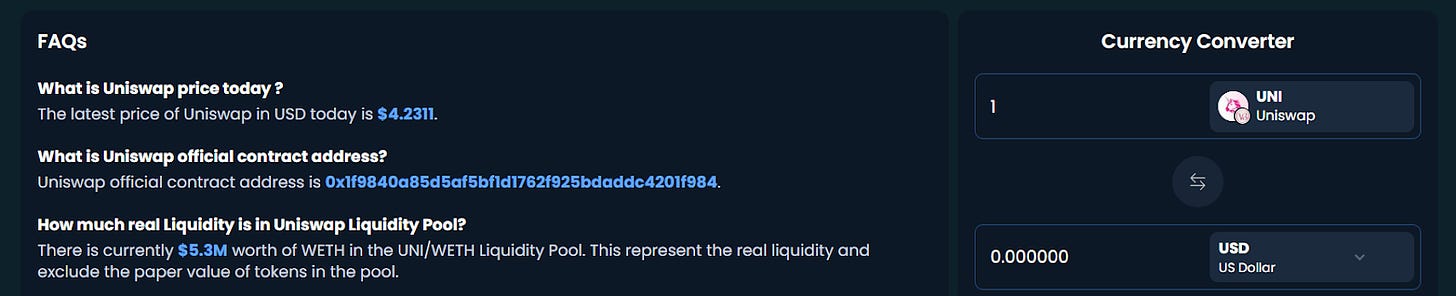

While this is not an endorsement or financial advice, Heurist on Base network might be a good one to look at in terms of raw fundamentals. Heurist’s agent has the second-highest number of users and interactions among the top agents in the past four weeks.

In addition to the agent, Heurist provides key resources and a framework for X402 payment protocols and AI. Part of the revenue generated from X402 transactions is used to buy back HEU tokens, which is also great…the buyback narrative also resonates among retail investors.

Another promising X402 project you could look at is PayAI. PayAI is an X402 facilitator. It provides tools for autonomous agent interactions.

PayAI data on X402

In the past 7 days, over 5,000 users have used PayAI to facilitate more than $1.2 million worth of AI agent payments through over 2.14 million transactions.

At a market cap of $9 million. It still has enough room for growth as X402 gets more popular.

Rounding Up

On one side, we have internet capital markets, and on the other side, X402 payments.

In commonness, each one attempts to shift from the traditional process and build value on a decentralized internet. ICM for fundraisers and tokenization; X402 for decentralized AI agent payment.

We discussed both concepts and how they are poised to make a dent in the crypto market. Having said that, I’d recommend focusing on value, not hype. Several projects will certainly attempt to extract value by adopting any of these narratives. But real builders always come out on top.