You’ve been told to keep throwing in more money on your crashing asset to reduce the average purchase price. Saylor bought over 20k bitcoins at an average price of about $34,000. Considering the difference between the highest and lowest prices he bought them; that’s a long journey and a whole lot of Dollar Cost Averaging (DCA).

Dollar Cost Averaging?

What does that even mean? Well, if you have the habit of buying more of a particular asset even as its price keeps falling down the cliff, then you’re Dollae Cost Averaging, without even knowing the general term for what you are doing. A majority of cryptocurrency investors do this a lot, myself too. A pure show of belief and dedication…or just greed.

Even your favorite Twitter influencer told you at least once to “fill your bags at these prices”. Even as the price goes lower, you still fill ‘those bags’. Dollar Cost Averaging and hoping for better days. Sometimes they come, other times…well, bagholding is also part of the game. If you are an active DeFi participant or a meme token connoisseur, you probably have tons of tokens you might never sell again. You kept buying down the molehill and now there is no way back up the dark pits. It happens.

The advice to keep buying the dip and HODLing is a popular one, but there’s something you’re not being told…yet.

In a space filled with thousands of projects claiming superiority, it is easy to lure investors with well-crafted promotional pieces. Everything runs down to why you should invest and continue doing that even when it all looks dark, or at least hold on to your investments and not exit the market even when you’re in gains. Influencers use bold words and appear more experienced than the larger majority; sometimes they really are. Other times, they are simply putting out their personal opinions and perceptions. This space still remains the most unpredictable investment option.

The main factors guiding your choices should be your personal convictions through detailed research and experience. External suggestions are only resources to help your research process and shouldn’t form the main basis for your decision.

That being said, Dollar Cost Averaging is a brilliant move…when done right. Getting it right isn’t a mathematical issue too. But consider these…

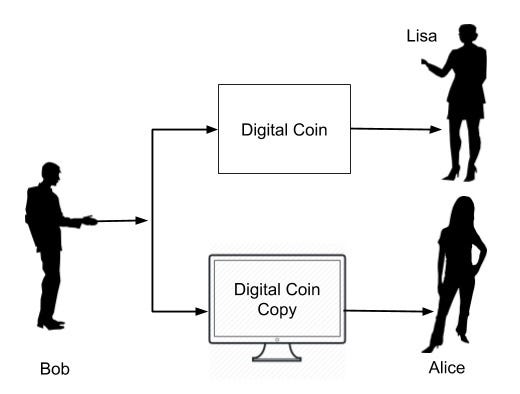

Before buying more of a crashing asset, questioning the reasons for the loss in value might be important to your decision. Getting greedy when others are fearful is unarguably a good move, but sometimes this could also backfire; in reality, this move is always risky. Taking time to make certain considerations before ‘getting greedy’ increases your chances of averting some disasters. Price may dip badly in cases of irregular acts by the team behind the project you are invested in, this always drives the price nuts and could possibly dip to its last point.

If a crash isn’t due to some extreme reason which affects only the project then there are chances of making a recovery. Pulling a recovery depends on two factors; the project making the right moves and the market reacting positively to its move. Recovery cannot happen without these two factors being met satisfactorily.

Taking a good at the team behind the project and their reaction to the dip is surely an important move to make. How the team is reacting to the drop in the value of their project and how they hope to get out of the ditch. In a situation where the team is already ‘exit scammed’ then this might not be possible. ”Almost impossible” is a better way to put it. Well, ‘impossibility’ is an illusion in space. But if a project team is gone for real, recovery is far-fetched.

Alright, there are chances for recovery; but to what extent? Certainly, if a project is determined to keep working harder after a huge price drop, it is poised to pull back some losses, sometimes the pullback is not relative to the drop. For a project which experienced a 70% price drop, making a 70% gain from their current position still keeps them below their former top level. This indicates the extent to which a project needs to go before a complete recovery. Well, sometimes it is easier to go up from the bottom.

While DCA is plausible and you’ve been advised to invest what you can lose; considering some or all of these also goes a long way to reducing your potential losses…at least.