The last quarter of the year is usually a dramatic one for the crypto space. One to look up to. I’ve been going through the assets in my portfolio and also looking into other assets and applying analytics to estimate their different potential going into the last weeks of the year. I’m personally not so much into TA analysis, fundamentals have consistently proven to be the most trustworthy metrics, especially for prolonged periods, say 4 weeks or more.

The whole year is setting up the tone for a green 2024, the whole market has been in consolidation for the majority of the year, and with so much silently bullish news coming up in the past few months, even the last months of the year looks promising.

My biggest bet for Q4 is the DexCheck token. Surprisingly, I got into DexCheck just last week, and have been doing deeper research on the whole project. I will be surely writing more about it in the coming weeks as I learn more. Apart from the technology, which is pretty solid, I’m looking at the potential of DCK, the project’s native token.

DexCheck token is at the heart of the DexCheck project and is positioned to grow even faster than the project itself. DexCheck token currently trades at $0.022 per token, the whole project is valued at just $3 million. For such utility, these figures might not last for so long.

Looking at the fundaments, these are some of the reasons why DexCheck token is set for an uptrend in Q4 2023 and Q1 2024;

Long-term Consolidation

DCK has been trading between $0.04 and $0.02 for the past three months. During this period, the daily trading volume has stayed above $150,000 on average. The strong market interest and balanced price fluctuation are strong indicators of long-term accumulation. Despite the project making significant breakthroughs during this period, the price has remained stable around this range. An interesting part is the accumulation pattern that has followed the short-term pump in the early weeks of October 2023. The charts look to be headed for another uptrend. Due to the long accumulation period, this could last longer than the last two peaks. This translates to up to 100% gain in the next three months.

DCK has shown built a strong support around $0.02 which is just a little above the recorded ATL, it is very unlikely that it will drop below this level. How the rest of the market moves might affect this, but if Bitcoin remains stable and doesn’t go below $27,000 during this time, DCK could be on its route to price recovery in the last quarter of the year or early in the first quarter of 2024. A price of $0.05 puts the whole project at an FDV of just $5 million and a total market capitalization a little below that. For a decentralized application that actually works, there is still so much room to grow at $5 million.

New Updates coming to the platform

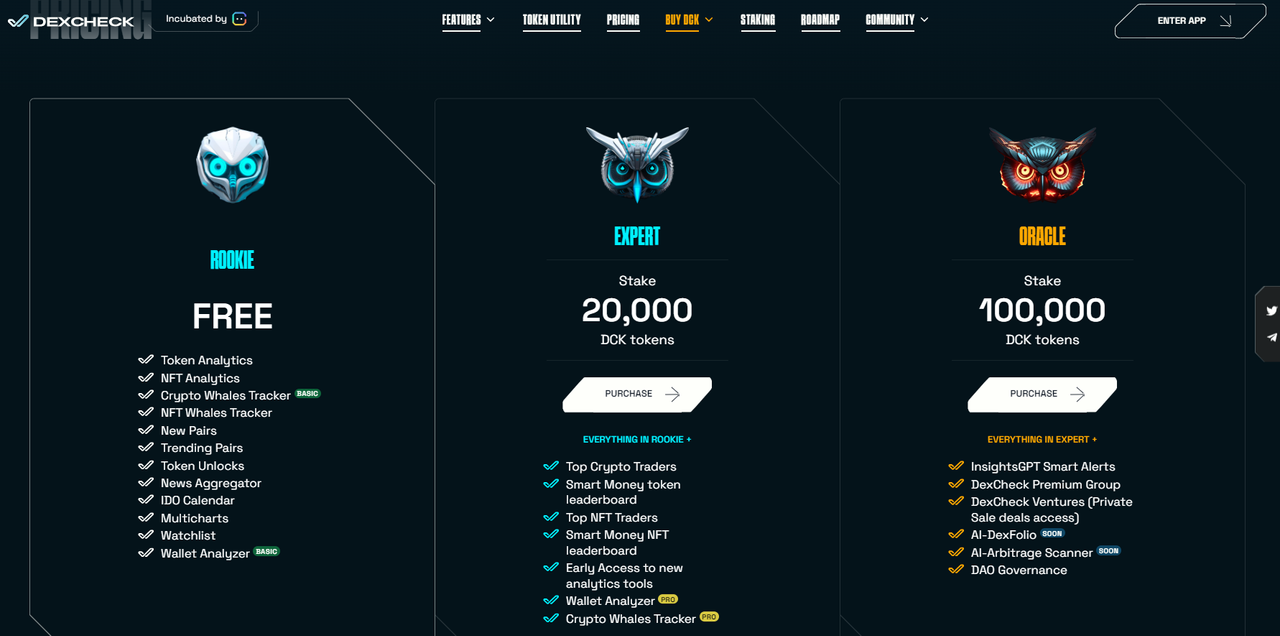

DexCheck announced a new staking pool for the DexCheck token with up to 36% APY. DCK token Holders can earn some good rewards by locking up their tokens in the pool. But this is actually the least update from the project. DexCheck has announced a handful of exciting updates.

I’m personally excited about the Initial Private Sale Offering (IPSO) feature. IPSO is a launchpad for new crypto projects powered by DexCheck. IPSO allows investors to buy into new projects before they start trading openly. This is reserved for DCK token stakers and is another way the project attempts to boost the utility of its native token. DCK holders can now invest in promising projects before anyone else and enjoy the full privileges.

The Beta version of the Smartfolio feature has also been launched and the roadmap hints at even more exciting releases in the last quarter of the year. On the technological grounds, this is good news for the project and the investors. how this affects the DCK token price depends on how the rest of the community reacts to the update, but price growth is likely if the new features work as promised.

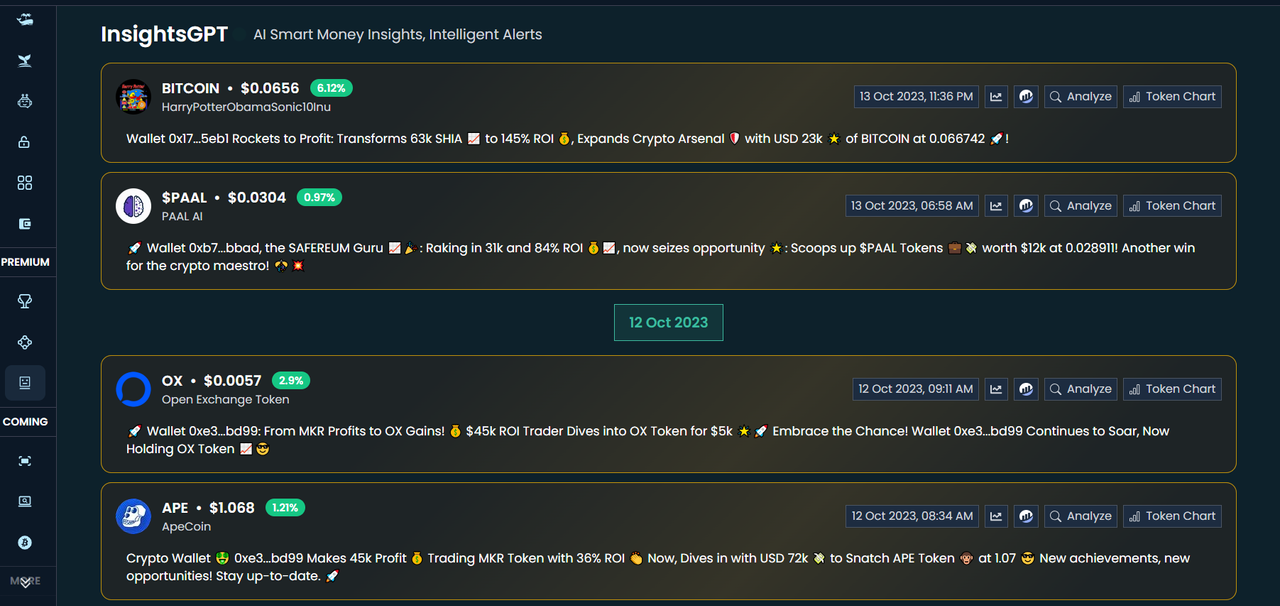

The AI and Trading bot narrative

AI-powered trading utilities made the headlines in the mid-quarters of the year. Some notable ones include Unibot, PAAL AI, and for a shorter term, DexCheck. DexCheck token, unfortunately, gained pace when the wave already started settling down. But this is normal in the crypto space, every trend gains an initial wave, settles down, and returns with an even bigger wave. We have witnessed the first wave of AI and messaging-app trading bots. But while the wave appears to be settling down in terms of the price of these projects’ tokens, the technology is actually growing and even more people are embracing the technology.

DexCheck’s Telegram bot has grown to over 2,500 active users in the past three months. This growth is continuous. Other Telegram bots have seen significant growth as well, but DexCheck seems to be catching up faster, relatively. With this growth pattern across AI and trading bot projects, both could experience another wave. DexCheck fits into both narratives, coupled with the current low capitalization, this is one to watch going into the last months of the year. The number of DCK token holders has also grown to over 4,800 at the time of writing, showing strong signs of adoption.

Exciting partnerships

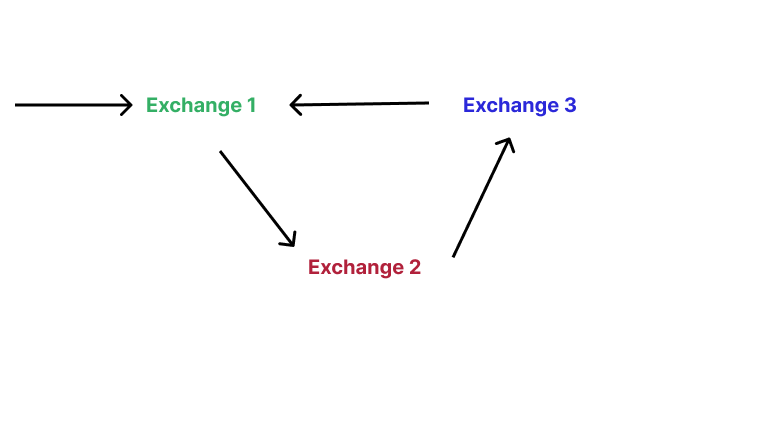

Between October, 10 and October 20, 2023, DexCheck has announced a handful of very interesting partnerships on marketing and technological grounds and doesn’t show signs of stopping any time soon! First, the marketing partnership with Kucoin Exchange is set to run for a couple of weeks. We will see the DexCheck token and project being marketed to traders on the exchange during this period of time, this could grow traders’ and users’ interest and an overall growth in the token value is not out of the line.

Apart from marketing partnerships, DexCheck has partnered with USDD to bring the stablecoin to the platform, as part of this partnership, USDD will also integrate the DexCheck trading bot into their platform. With the two projects pursuing mutual growth, we could see some benefits from this partnership. The partnership between DexCheck and Syncswap will also enable DexCheck to make an entry into the ZkSync Era network. This follows the expansion into the Binance Smart Chain.

DexCheck has also announced a partnership with InterSwap to bring more AMMs into the platform. DexCheck is growing its community by expanding into new communities. This is yielding returns in terms of adoption, it is only a matter of time before the DCK token catches up to these developments too.

Bitcoin ETF

A fake Bitcoin ETF approval news caused a rapid price jerk throughout the crypto market earlier this week. Even though this didn’t turn out how every crypto investor wanted it, the price movement is a micro show of what could happen when the first Bitcoin ETF gets approved. How the news unrolled is yet to be fully diagnosed, but from developments around the ETF fillings, the first Bitcoin ETF could be around the corner, the last quarter of the year could be the time. This is a wild guess, but has some backing to it, judging from how things have unfolded in the financial space.

Bitcoin ETF as a factor here is from the widely known “bitcoin pumps and others follow” pattern. If Bitcoin finally moves big, the DexCheck token will be one of the best-positioned assets to move even harder. The Bitcoin effect is hardly avoidable, the whole space appears to be tied to its movement and the DexCheck token isn’t different. If Bitcoin moves, DCK is the token to watch closely.

Final Thoughts

There is a lot on the line for the DexCheck project, and its utility token is certainly not being left out. To get the best out of the platform, the DexCheck token is a must-have, the tokenomics is in the best interest of the investors. The market usually moves toward the real builders and the team has been working hard behind and on the scene.

However, Predicting price developments for crypto assets is tough. Fundamentals are the best bet, but this could also go south. DexCheck is being run by a dedicated team, which is one of the most important clues for investors. While the team strives to grow the project, the market could also react differently or less than expected to some new developments. That being said, always do your own research before investing.