2023 is one of those events you cannot describe with one word. It’s been a hell of a year! If anyone in the government gets to read this; consider extending the holidays. Unfortunately, in the capitalist world we live in, this isn’t even up to the government anymore. One of the year’s biggest events in crypto is Bitcoin’s climb to $44,000 from levels below $17,000. An over %150 rise in a year is a significant one. Ethereum hit $2,300 as well…at least we are leaving this year better than we met it. Yes ‘WE’.

Well, while you decipher that, here are some of the notable events of the year;

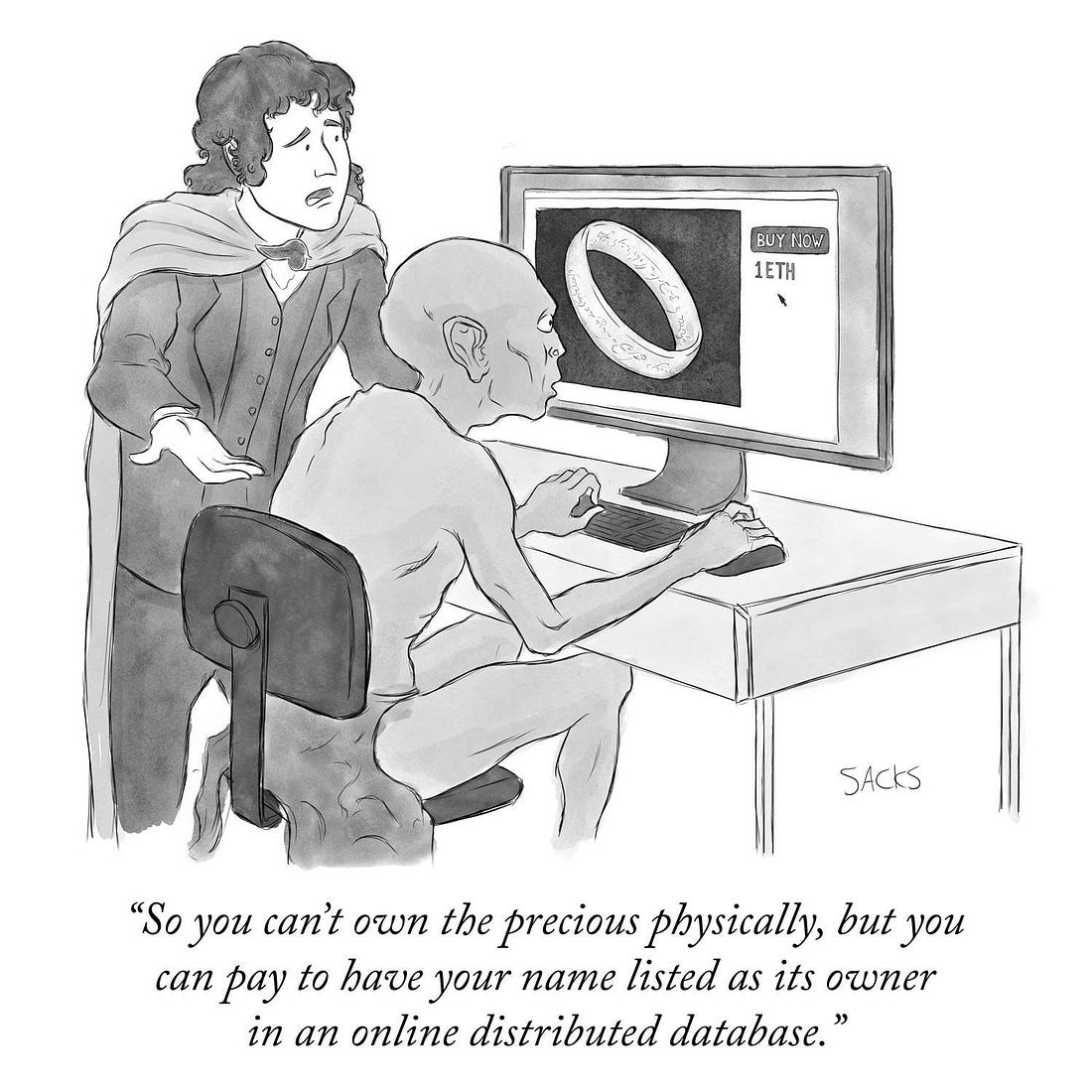

Rug Pull, court, jail

Forbes’ ’30 Under 30’ is the new prerequisite for jail time, at least that’s the new conspiracy theory. It’s not really a ‘theory’ when we’ve seen it play out quite a couple of times this year and even the years before. In the crypto space, there’s been lots of court time and jail time. Luna guys, FTX guys, and maybe Binance too. Different levels of Rug pull. We will keep calling out the memecoin rugpulls, but the CEX rugpulls are a thing. The space needs regulation, no doubt, even though the regulators aren’t the best kind of people. Several interventions have seen notable figures in the space go through court sessions and potentially, jail time. Financial crimes aren’t a joke, but we can’t keep ourselves from finding something funny out of any situation…like the courtroom painting of Mrs. Caroline.

Institutional insurgence on crypto

Multi-billion dollar mainstream financial institutions are steering into the crypto space in many ways. The mainstream VC invasion has been a thing for a while, but some big money institutions are launching spot ETFs for cryptocurrencies. Bitcoin, Ethereum, Bitcoin Cash, and LiteCoin. According to rumors, there is one for XRP…and PEPE. Not sure about these two but if the rumors are true, then the theory about mainstream institutions “coming for your Bitcoins” might be true as well. The BlackRock spot ETF for Bitcoin is yet to launch, but ‘rumors’ have it that we are close. Didn’t happen this year, maybe next year. Regardless, of the intent, we are seeing an increased mainstream exposure. This could be good for the price, we are not sure what it means for ‘Satoshi’s Vision”, but the random altcoin trader will take a solid 10X over that.

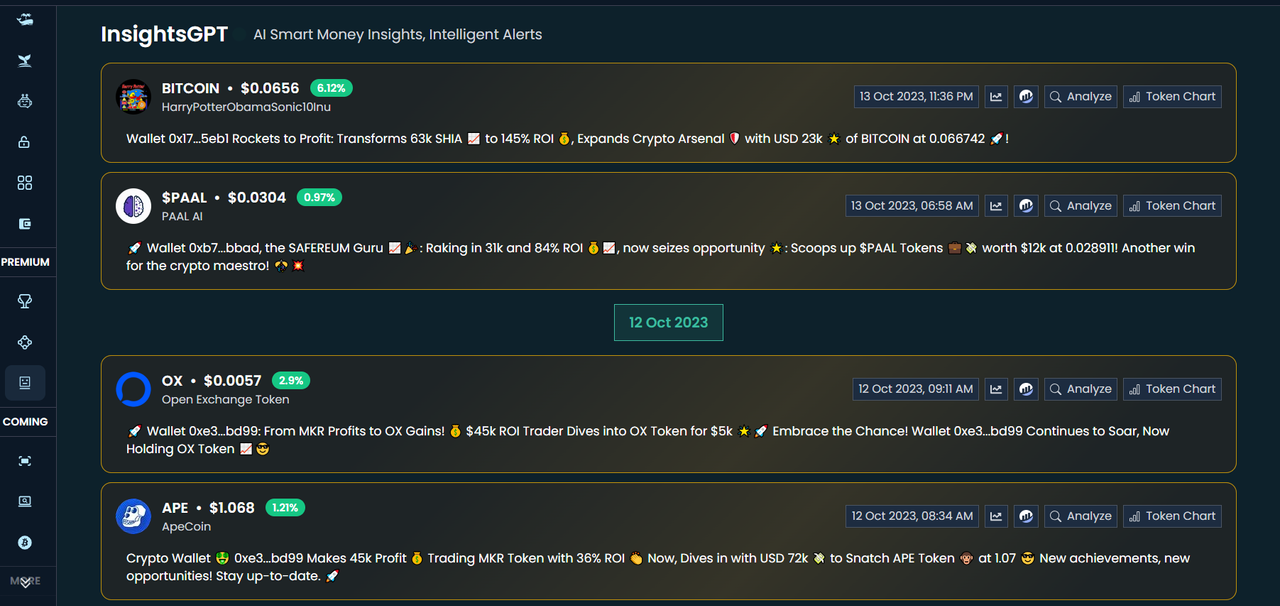

L2, Meme, Cashout, repeat

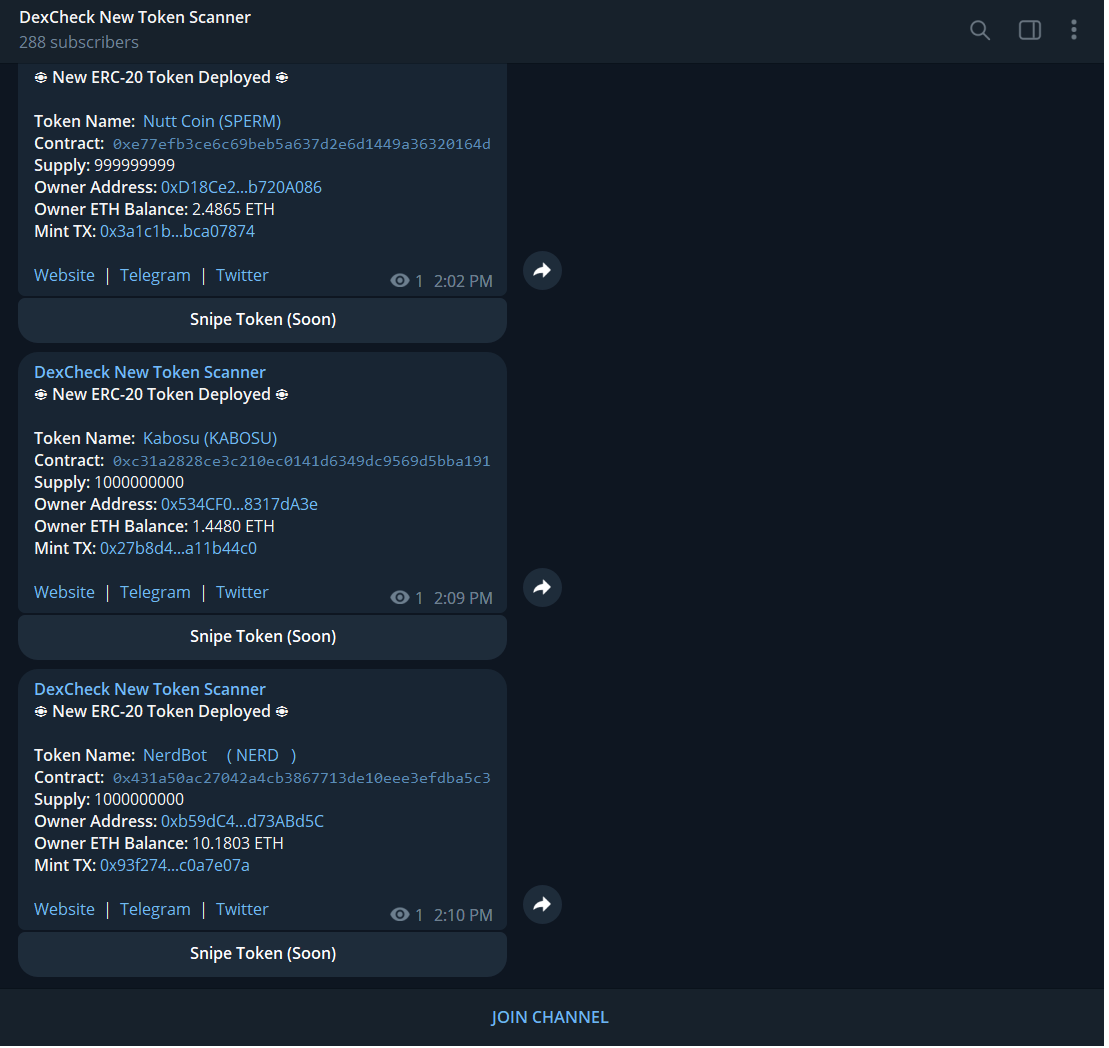

Over 11,000 cryptocurrencies are listed on asset-tracking platforms. Untracked assets are at least twice this figure, mostly memecoins. ‘Blue chip memecoins’, RugPull memecoins, and proper memecoins that accept their fate as being reliant on pumpamentals…and luck. But if you made that quick 10X on assets like this, then you can proudly enjoy your win. Like the past two years, 2023 witnessed a flood of memecoins, just like the tons of Layer-2 scaling solutions that launched this year. For each new L2, there are at least 50 memecoins, we’ve lost count of the memecoins on Ethereum and other L1s. Many L2’s usage statistics ride on the back of memecoins, and this is fine. We just want you to know that Memecoins didn’t die in 2023, we’ll check again in 2024.

Bitcoin – The new ‘Ethereum Killer’

BRC-20, BitVM…the Bitcoin blockchain now runs its own kind of smart contract. On the bright side, you can inscribe data on the Bitcoin network, on the other side, the Bitcoin blockchain was developed for the sole purpose of P2P transactions. The experiments are cool, but the after-effects are also significant. But this is not the time to say these; this paragraph only serves to inform readers that Bitcoin could be gearing up for a (very) new set of utilities. BRC-20 tokens and NFT-like inscriptions made the wave in the second and third quarters of 2023. The hype has died down since this time. The team behind BitVm is developing a Virtual Machine for the Bitcoin blockchain, these developments could shape 2024.

The Airdrop hunting continues

Every new protocol that launched in 2023 reached the one million user milestone in a very short time. We’d like to attribute this to the quality of these projects. But once we are done with that, we’d also like to talk about an obvious major contributor – Airdrop hunting! Lots of juicy airdrops from 2020-2022 and no one wishes to be left behind in the next multi-thousand dollar earndrop. So, the hunting continues. Good enough, even more projects have conducted such programs this year; Arbitrum, Celestia, PYTH network, no need for a long list. The average airdrop hunter should have something to show for the ‘hustles’ this year!

Not to jinx it, but 2023 looks like a perfect tone-setter for a massive 2024. The coming year is packed already and this year has done a good job at shining the lights to even better things…hopefully. If we don’t witness another Luna-level collapse, 2024 might just be the year. 2023 was a huge role-player here. The whole space has gone through a huge rebuild and regardless of how it went on individual terms, it is another one for the record books. And if you ever thought memecoins would fade out one day, this year is a good reminder that things like this are part of what makes this space what it is. The lights fade; the show continues in 2024!

Follow up with CRYPTOCURRENCY SCRIPTS to stay refreshed in the crypto space with comprehensive articles and important tips.