In a space of a few months, I’ve seen an alarming number of people lose their crypto assets. The number of victims is mind-blowing, but the fact that these assets were stolen from their personal wallets makes it even more surprising.

Personal wallets are thought to be a better option for the safekeeping of crypto assets than exchange wallets. Trustwallet and MetaMask are amongst the best mobile wallets to store your crypto assets, this is where the full surprise comes in. Most of these victims stored their assets in either TrustWallet or MetaMask, yet these assets were lost in the most tragic way.

Crypto assets are precious stuff, the thought of losing them is a pain only the bearer can properly explain…I actually doubt if anyone can properly explain the feeling that comes with losing a crypto asset.

Maybe I need to correct an impression; your cold wallets are still safe. These hacks aren’t directly on the blockchain. Perpetrators have developed special social engineering techniques and some good technologies to support their fraudulent activities.

Keeping your assets in a personal wallet is thus not the only thing that keeps you safe. In addition, keeping your wallets ‘safe’ is also vital. It’s a bit complicated, but here are a few tips to help.

Keep your wallet SAFE

Crypto assets are the best items to steal; yeah, that sounds a bit crazy…I know. Thanks to the anonymity features of cryptocurrency, a successful heist of crypto assets are hardly traceable. Perpetrators easily go away with stealing cryptocurrencies, especially when they don’t belong to a big organization. This put individual investors at high risk without tangible external security support.

Mobile wallet users are not only vulnerable to hacks, but physical theft also happens at a high frequency. With these in mind; the importance of keeping your wallets safe can not be overemphasized. Keep it as safe as possible. Yes, your wallet and your phone too.

Just like a dangerous chemical, keep them out of reach. Everyone is capable of siphoning your assets if they get sufficient access to them. For a cryptocurrency investor using mobile wallets, your phone should be private property. This means lesser freedom with how you share them with anyone apart from yourself.

Sounds harsh but you might have to be strict with your mobile phone and disciplined too. Unsupervised use of your devices by any external person is a poor security practice.

If you feel these rules are hard to adhere to, then consider getting a separate device for your cryptocurrency wallets. Probably the best practice.

Keep your Phrase/key SAFE

Here’s one piece of advice, “if you can’t keep secrets, then consider learning them before investing in cryptocurrency!”. Not just cryptocurrency, the internet, and most other forms of investment. Your keys, your investments; every vital detail of your involvement in cryptocurrency should be kept as secret as possible. Now that’s one hell of a task, but one you must perform if you must have a nice story to tell about your investments.

Blockchain-level security protocols are almost impossible to breach without external aid, hackers are aware of this. As a matter of fact, most hacks are actually socially engineered. The easiest way of getting your security breached is through you. Hackers are social engineers; most hacks are done with tips given up by the owners of the accounts. Keeping your security details safe is your obligation. Social hackers devise means to obtain these details or helpful hints about them (your details) from you.

Developing strong passwords is just one step toward your security, keeping these passwords safe is another (more) important step. Each of these is a tedious and sensitive process. A couple of writings on security tips suggest the best practice in password development. Taking a look at these tips, developing abstract passwords is the safest way to do it.

A password without reference to common knowledge of you is unarguably harder to guess. Popular ways of developing passwords such as; a combination of your name, birth date, and other notable dates, hobby e.t.c have simplified ‘hacks by guessing’ in many known cases. An abstract password makes guessing harder for the intruder. However, a strong password not properly stored is in fact weaker than a weak password. It all boils down to one thing; ‘keep it secret, as much as you can’.

Interacting with Decentralized applications (DApps)

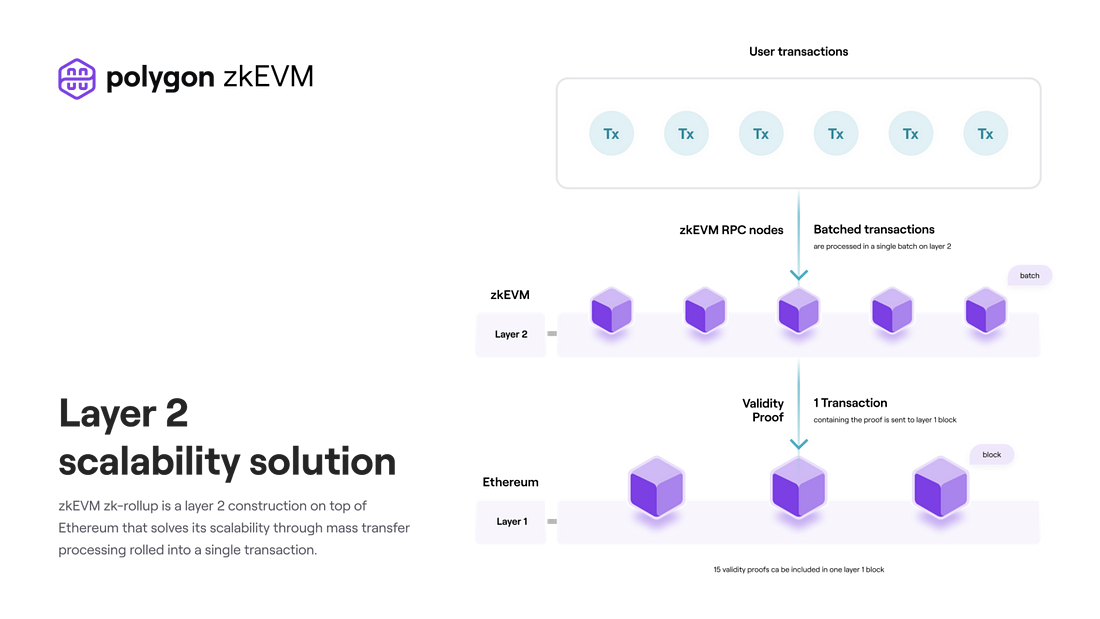

Decentralized applications are utility platforms built to interact with the blockchain and sometimes your wallets. They possess connectivity features that allow your wallet connects to the platform. This connection gives the platform certain automatic access to your wallet. Administrators of these platforms or hackers can harness this short-term breach in intact blockchain security to meddle with personal wallets. Original DApps can also be cloned to target unsuspecting users.

For a personal wallet user, ensure to doublecheck the DApp’s website to ensure that you are visiting the right website. Also, do well to confirm the audit report of new DApps. Ensure that the project team is a trustable one and wouldn’t meddle with your assets as you connect to their website.

Watch out for Scammers

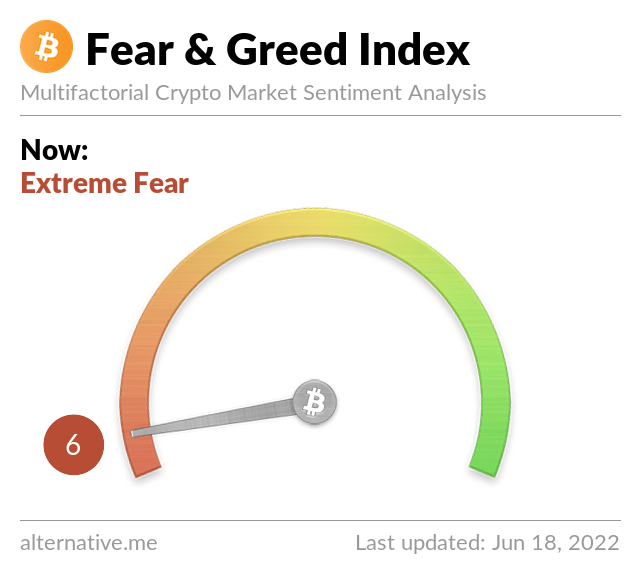

All those glitters are not gold. Regardless of how many times this warning is sounded, people still get unhealthily drawn toward shiny things. Shiny ideas, shiny projects, undeserved gains. The simple truth is, “if it sounds too good to be true, then it’s probably not true”. But greed clouds personal cognizance and in the pool of our greed, everything sounds good and everything is possible…like getting $3000 daily from a $1000 investment in a shady mining firm.

Human greed is the biggest tool for scammers, tricking your greed and getting the best out of it. The most tactical scams are simply ones most developed to put your greed to work in the best way. Scams are the biggest threat to every cryptocurrency investor. Falling into one is way easier than you’d think but also relative to your greed level. Greedy investors are more vulnerable. Fix your greed, said it for the second time!

Strategies used to break into user accounts are ever-evolving, everyday birth a new way to get to break into ‘secured’ profiles, looking out for existing and emerging means of scamming investors, and taking precautions to stay safe from them by applying advised security measures is the most effective way to protect your funds and stay safe in the internet