Every cryptocurrency investor shares the random thought of bitcoin getting ousted. The oldest cryptocurrency and blockchain has spent its whole years of existence on top of the charts. Dominating a fast-growing space and pioneering tremendous developments; the ‘future of money’ controls over 30% of the total crypto market valuation. The top list is ever-changing, a number of projects have occupied positions in the elite league. Only a few have kept this position for a reasonable duration. The competition at the top is stern, but for bitcoin; it is lonely at the top.

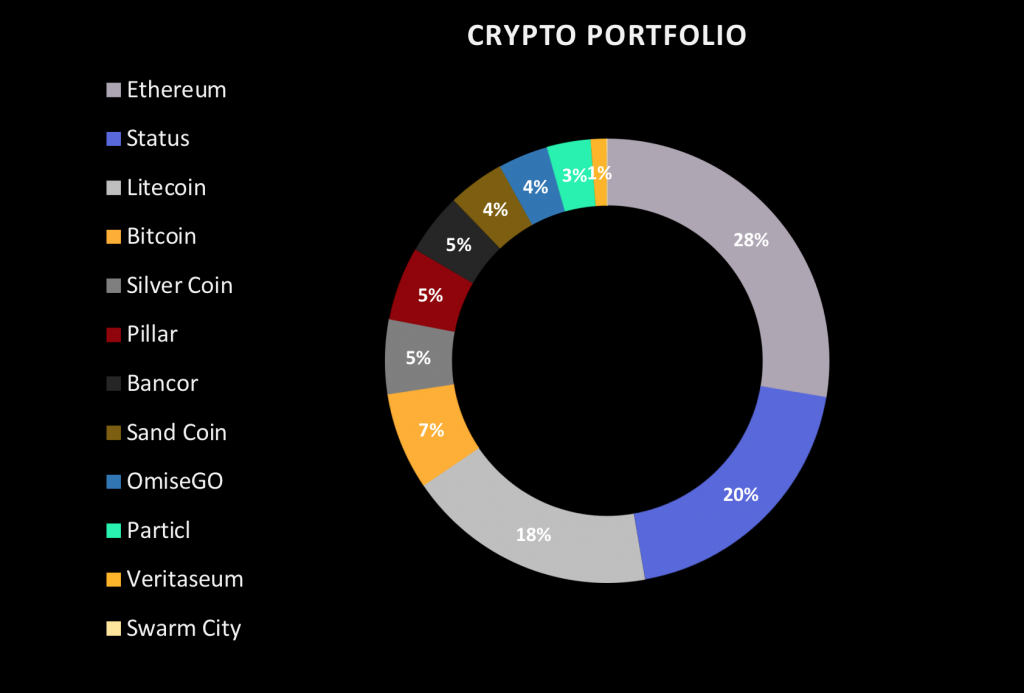

Apart from the alpha cryptocurrency, only one project has spent a ‘long’ time in the elite position — Ethereum. Vitalik Buterin developed a technology that has won the heart of many. Since its debut in 2015, Ethereum has become a household name in the space. The most used and emulated project, that’s a simple description for Ethereum’s reputation amongst developers and enthusiasts. The most actively developed too.

Thanks to brilliant technology and widespread adoption, Ethereum has claimed a position just below bitcoin. Unlike other projects that once occupied this position, it has retained it for a relatively long time and had been dubbed bitcoin’s successor. Well, dare to dream. If any current cryptocurrency project stands a chance of taking over bitcoin at the top, it’s Vitalik’s brainchild.

Does Ethereum have what it takes to move to the absolute top? I’d say YES; technically. But then these need to happen before that…

Ethereum’s ascension will need a little bit of bitcoin’s share of attention. Not just bitcoin maximalists, the whole space is much dependent on bitcoin and what happens around it. The old ‘reserve currency’ is currently the sole dictator of the direction of other assets in this space. It will be tough for Ethereum to climb to the top while bitcoin retains this undisputed rulership figure. The bitcoin hype needs to die, at least a little. This won’t be easy, bitcoin moving over to second place will be a bizarre sight too.

Anyways, bitcoin’s hype isn’t the only impedance on Ethereum’s ascension. Ethereum has its own problems too. Fees, speed…you name it. Despite being the most developed blockchain to date, the smart contract chain is still unusable to many. If any cryptocurrency is going to trump bitcoin, it has to be special. Ethereum is special, no doubt; it still needs a whole new level of efficiency to move over to the number one position. A lot of developments are rumored to be coming to the chain, maybe this will be a revolution…who knows.

Unlike bitcoin, Ethereum is built for several purposes. There’s a long list of unique things that can be built on the chain. The quality of projects built on Ethereum has a big impact on its growth. The tons of projects currently running on Ethereum are the principal reason for the price growth over the years. This growth will continue for as long as reputable projects launch on Ethereum and existing ones continue to make great progress. However, if Ethereum will ever grow past bitcoin, mainstream institutions will have to build alternatives or replacements for normal products or services on Ethereum.

Visa recently shared plans to build a payment solution on Ethereum. This and even more are possible on Ethereum. Mainstream firms and brands can launch incredible services on Ethereum. This will boost the price greatly and ease Ethereum’s journey to the ultimate top.

Just like Visa’s payment solutions, Central Bank Digital Currencies (CBDCs) can be launched on the Ethereum blockchain. Most cryptocurrency enthusiast frown at CBDCs, but the reality is; they are here to stay. Not just here to stay, they stand more chances of survival than most normal payment solution crypto projects. Most governments are building their own blockchains to launch CBDCs. While this is for obvious reasons, the Ethereum blockchain can easily host as many CBDCs as possible. Nations should consider taking this route, which is relatively cheaper and easier. Ethereum as a hub for CBDCs will be a huge boost for adoption and value as well.

You surely have your preferences and you hope to see them at the top. If anyone is ever going to come too close to overthrowing bitcoin, Ethereum is first on my list. This space is unpredictable and the most reasonable scenario is bitcoin retaining its position. But anything is possible and Ethereum could go all the way. Or XRP? Well, feel free to dream!