Just like most other hyped blockchain concepts, DeFi has become a goldmine for many believers. Unfortunately, a tangible more has a relatively different story to tell; but that’s a topic for another day. Diving in early into deFi and exploring the vast opportunities it offers has earned this class of people, life-changing opportunities. Luckily, it is benevolent enough to benefit even newer participants as well.

DeFi is powered by lots of brilliant algorithms, protocols, and project teams, but as usual; it is the ‘money-minting’ potential that attracts most participants. A Normal phenomenon in this space. Well, I wouldn’t blame an investor for levitating towards a platform that promises a 10x annual return on investment, hassle-free. Not just the rewards, the projects’ tokens go parabolic too.

It takes a special conviction to ignore the high APRs on DeFi staking pools and liquidity farms. Like the early days of cryptocurrency mining scams, these rewards seem too good to be true. Actually, they are true; at least they work as stated. But these DeFi incentives aren’t really ‘free money’

Most airdrops aren’t even free money in the right sense. Airdrops are known for the ‘free money’ tag and have maintained this reputation over the years. But the tasks associated with certain airdrops are in fact more worthwhile than the airdrop rewards. Staking and liquidity farming is, however, different in many ways.

One is a tokenomics and marketing strategy; the other is a proper reward for a (vital) service; staking and liquidity farming have become the most accessible and arguably lucrative DeFi opportunities.

Staking is a low-risk reward program that incentivizes token holders for locking their assets in the staking pool. Staking rewards are flexible and Annual rewards may vary depending on the platform and circumstances. Most DeFi staking programs are flexible too and stakers can unstake their assets from the pool at any point in time. Others might require locking your assets for a specified time during which these assets cannot be unlocked or can be unlocked with penalties. The DeFi staking process is simplified and is a popular choice for micro and medium investors. Most investors prefer staking over liquidity farming for some reasons…

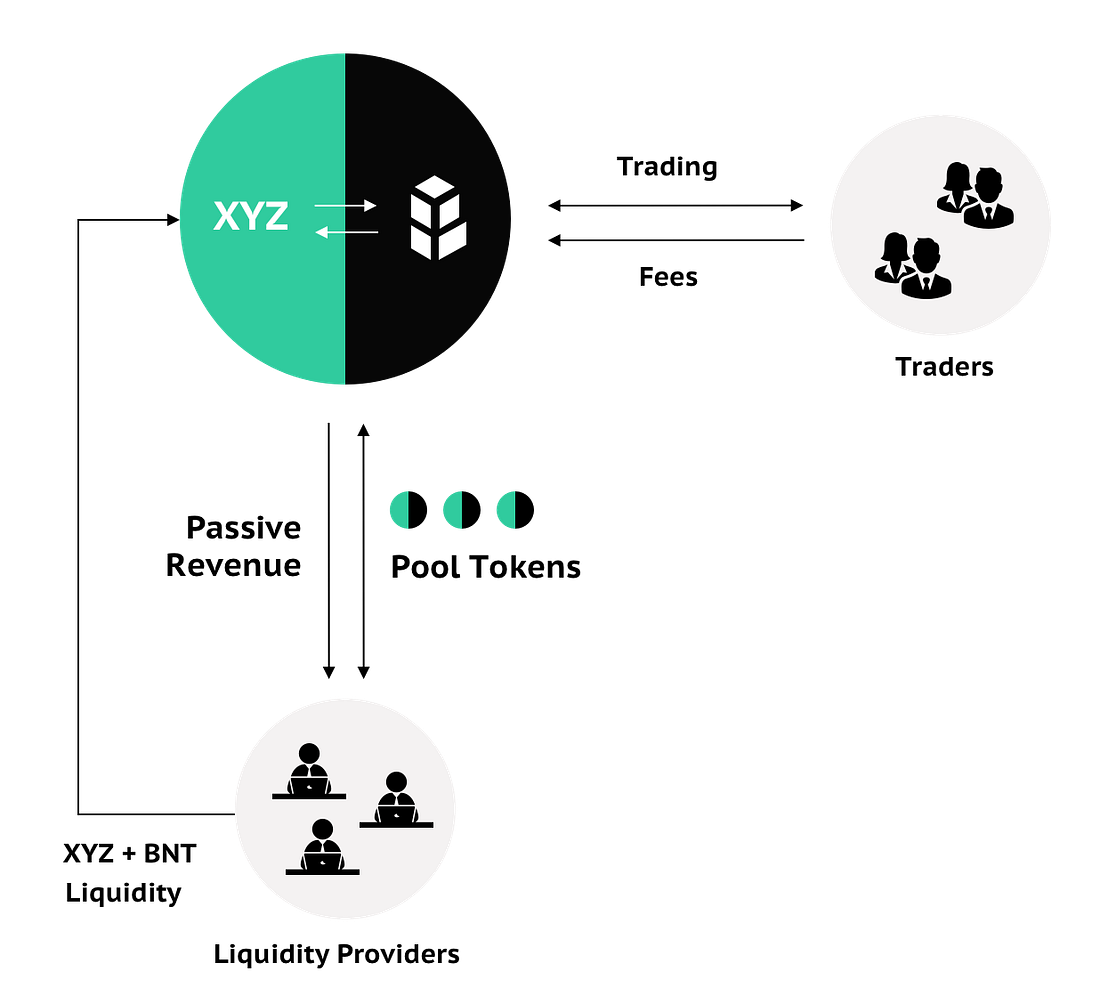

Liquidity farming on the other hand provides investors an opportunity to earn more tokens by locking their assets in the liquidity pool. Assets locked in the pool enable seamless swapping of the locked tokens. A liquidity provider locks an equal value of a pair of tokens/coins. Other holders can swap any of the pairs in a simplified swap transaction. This is powered by Automated Market Makers.

Liquidity providers are in fact one of the most important parties in decentralized exchanges. The role they play is irreplaceable. The reward for this role is the liquidity provider fees. Some projects go ahead to set up an extra incentivization scheme — Liquidity farming. Liquidity farm APRs are usually higher than single-side staking.

‘Free money’ might have different definitions by different people, but amongst these two, Single-side staking would fit into most of the definitions. Liquidity farm rewards are more of compensation for a very important service. Liquidity providers risk losing a tangible percentage of their investments to impermanent rewards depending on the volatility of the market and the assets they supplied to the liquidity pool.

Want some free money? Well, you are better off staking your assets in a suitable single-side staking pool. Sometimes, liquidity farm rewards aren’t enough to pay for the impermanent losses incurred by variations in asset value. In contrast, staking rewards are closer to being ‘free’.

There is no ads to display, Please add some