Your reluctance to join the non-fungible token (NFT) trend is a result of any of these two instances; either you’re a maximalist of a non-nft project (probably bitcoin) or you’re discouraged by certain ‘not so good’ aspects of digital signatures.

Previously I questioned the value system in the NFT space, but that’s just one out of the whole bunch. The current scope of NFTs is limited to just multimedia vending; a very narrow use of NFTs, in my opinion. Apart from buying and selling digital art; NFT’s utility extends miles beyond the exchange of multimedia ownership. Maybe when the wave settles, these other use cases will come to life.

Just like every new idea, critics have presented these shortcomings of NFT technology in their arguments. But while these criticisms are valid, they don’t totally dampen the brilliance of NFT technology.

Alright, here are some of the most popular arguments against NFTs.

“Right-click and save”

If you ever tried to read more about NFTs, then the higher probability is that you’ve come across this phrase. Right-click and save!…easily the biggest argument against NFTs. Your NFT art can be easily saved and used by anyone. Just like a royalty-free picture on art vending sites, this argument is by far the scariest turnoff of NFTs. A fact any NFT investor should consider and understand before throwing a dime on digital arts. But just like I said earlier, even though this is a fact NFT art collectors need to worry about, it doesn’t bite down on NFTs’ brilliance. Saving a picture doesn’t make you an owner…in essence.

But do you even ‘own’ the multimedia attached to your NFT? Well, let’s get to that later.

Transaction fees

The part where blockchains claim to be a ‘cheaper’ option to mainstream alternatives should be wiped and rewritten with vague letters. Certain blockchains are multiple times more expensive than using custodial financial institutions; I’ll leave you to name these blockchains.

NFT transactions are one of the most complicated smart contract operations currently. Minting, selling, and buying; each of these transactions involve a number of protocols working together. This generates so many charges that depending on the blockchain, it could easily scare off investors and creators. A number of blockchains charge cheaper fees for NFT transactions, but unfortunately, they are less popular than the costlier ones and might mean lesser exposure for the creator and smaller options for the buyer.

Valuation

You just saw an art you love on an NFT marketplace, but you had to let it go. You couldn’t afford it. If pixelated art with negligible attributes could cost a few numbers of Ether, you can only wonder what real art and photographs would cost. Well, most times they cost way lower than this pixelated art. I might be oblivious to the process of creating these arts but the valuation system in NFT is questionable.

Tron’s Justin Sun has a history of extravagant spending, but top on his list is the millions of dollars he spent buying an NFT art. I’m clearly not a big fan of his; this is another reason to understand this stance. Certain NFT arts are way overpriced. If you ever tried to justify these prices, you will end up understanding the poor value system. A hype or a boom? I think a combination of these two words best explains the current state of things in the NFT space.

Liquidity?

You just bought an NFT for a certain price; you might have to worry about selling it. Unlike cryptocurrencies where an active market exists, NFT owners will have to go through the process of finding a buyer for their art. Just like the Barter trading system, the liquidity system for the NFT system is a burden for both creators and buyers.

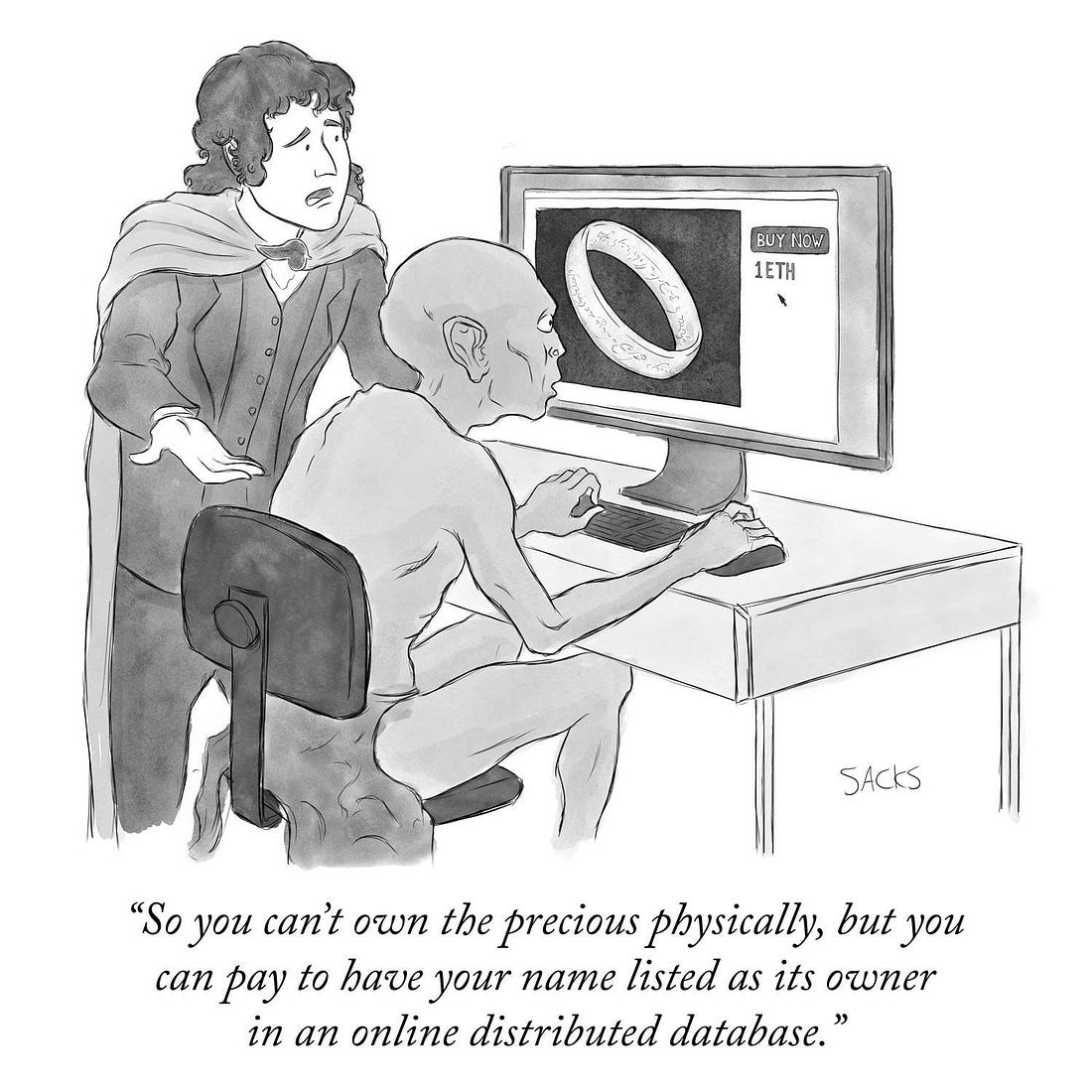

Ownership

An art creator sold his art for a few hundred thousand dollars and went ahead to make this same art free of copyright issues. It raises a huge question for art collectors: Do you really own the art attached to your NFT? I probably need some extra answers and arguments. Personal research couldn’t provide enough clarity on this. If everyone can use the same property you paid a lot for without any form of permission or royalty, are you really even the owner of this property? Something art collectors should really consider before buying any art. The sellers’ integrity should be considered first.

For art with several mints, the ownership rights are presumably distributed between all the buyers. In a case like this, every buyer reserves the rights to the ownership of this art, the question comes up again; Do you really own the art attached to your NFT?

Rarity

How rare is your art? Very rare right? Not sure if you can freely say the same if this particular art can be minted again and resold by the owners; or scammers. I’ve come across a number of instances where this has happened and the question gets even more important. Is it really ‘rare’ or is the statement just for aesthetics? Not sure what the perfect and factual answer to this could be. Another huge turn-off for non-fungible tokens.

Scams and hacks

If you still have your bored apes, then you are one of the lucky ones. A good number of people don’t have theirs anymore. Nope, they didn’t sell it; they lost it. If you’ve been following NFTs, you might come across this hazard a few times. Just like your cryptocurrencies, your NFTs aren’t safe. But here, securing your NFTs is way harder.

I admit it, NFTs are cool, but these turnoffs are huge points to consider before dipping your toes into the non-fungible waters. As a creator or collector, these issues span across every party involved in NFT.