Prior to the hard currency era, the barter trade system attaches value to real goods. Even in that era, real goods become a token of exchange. The valuation of an item depends on its availability and the demand for it. Tokenization is as early as ‘exchange’ itself.

A Token is a store of value attached to a concept, an event, or a project. Tokens attached to a project tend to embody the value of the project itself. A token hence is a representation of the value of the concept it is attached to. In simpler terms, a token derives its value from the concept or project it is attached to.

Tokenomics in plain terms is Token economics. Broadening this definition, tokenomics, it’s the science of token valuation, it encompasses every financial aspect of a token attached to a project and every effort of the project which affects the value of the token.

With the pitfalls of the barter system over-shadowing its advantages, concerned governments sort better ways to exchange and ease the burden associated with the barter system. This gave birth to our present-day idea of Tokenization. Introducing many solid materials as a store of value, and finally issuing Currencies as a store of value, these governments not only tokenized the market and the commodities traded, they tokenized the country/community as a whole.

Tokenomics in cryptocurrency

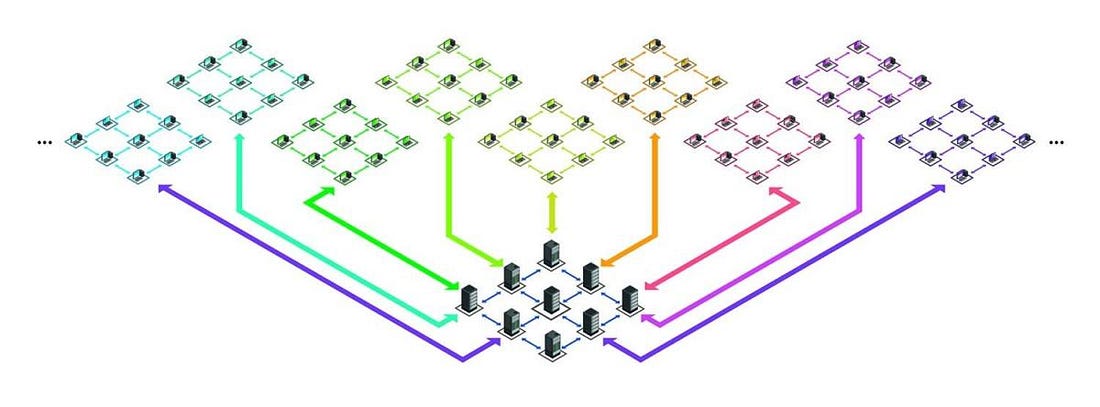

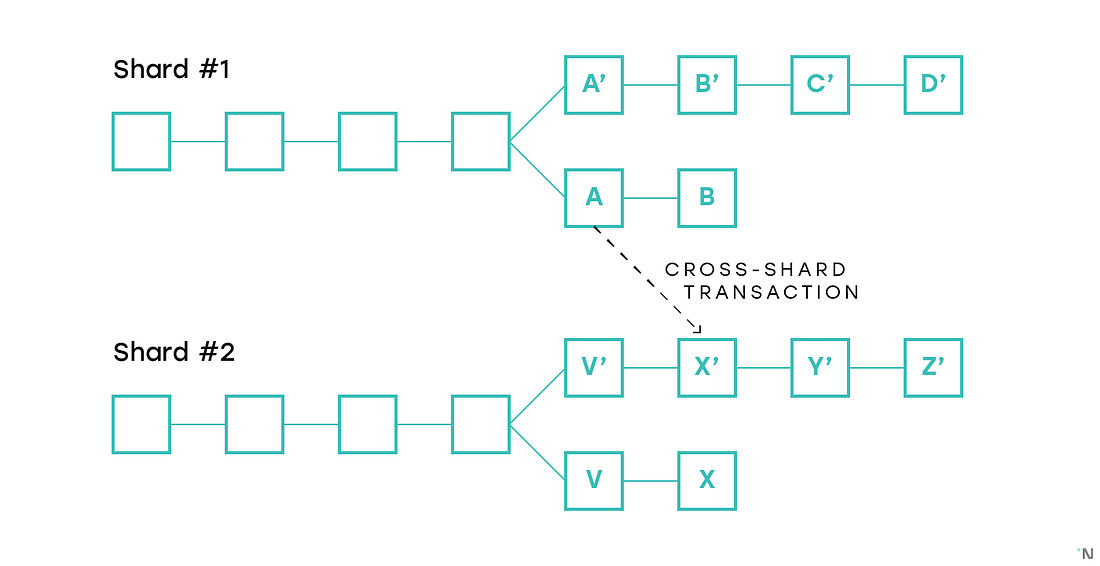

Blockchain technology has gained numerous applications. As a versatile technology, it supports several use cases depending on how it is been developed and the applications built upon it. For some of these applications, it is used plainly as a blockchain.

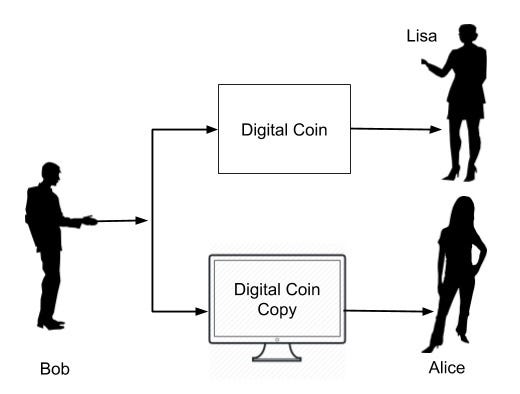

However, for most blockchain projects, cryptographically generated tokens are created to allow their users to perform some activities on the blockchain. Such blockchain projects are said to be Tokenized. cryptographic tokens assume the role of a token in its real sense.

Cryptographic Tokens attached to blockchains are generally known as cryptocurrencies. Apart from enabling users of the blockchain to perform activities on the blockchain, it incentivizes the users and represents both the financial and technological strength of the project. Cryptocurrencies reflect the value of the blockchain project which is attached.

What’s in the economy?

Token generation and distribution

Scarcity breeds value, this is a prominent idea in tokenomics. Cryptocurrencies are not indifferent to this. The rate of generation of blockchain tokens and the distribution scheme affects its reputation and subsequently value. Cryptocurrencies are generated via mining or staking as the case may be. Smart contracts blockchains also allow the creation of separate tokens for applications running on them.

For Proof-of-work blockchains whose tokens are generated by mining, miners are rewarded with tokens for solving puzzles and mining blocks. The number of tokens rewarded per block determines the rate at which the tokens are generated and this also affects the distribution. Blockchain developers introduced the concept of ‘halving’ to reduce the mining rewards over time hence reducing the rate of generation and distribution in order to build value. Projects with pre-mined tokens are often discriminated against as this is already a poor tokenomics practice.

Proof of stake blockchains rewards their users for locking up a certain number of tokens in their wallets or in a staking pool. This is a passive way of generating tokens. The number of tokens rewarded to each staked depends on the number of tokens they have locked up in their wallets or in the pool. Proof of stake blockchains also meets some discrimination as a passively earned token hardly earns enough reputation. Users are more eager to sell off passively earned tokens.

For the above reason, proof of work blockchain tokens usually get valued more than proof of stake blockchain tokens. There may be exceptions to this due to reasons mentioned below.

The functionality of the blockchain and utility of the token

Regardless of the generation and distribution scheme of any cryptocurrency project, the functionality, and utility of the blockchain is paramount. This simply explains why ripple sits third on the market capitalization ranking with over forty (40) billion tokens in circulation. How does the blockchain work? and what use is the blockchain? A good cryptocurrency investor must first ensure that the project answers these questions satisfactorily.

For national currencies, the GDP and financial stability of the nation play major roles in its valuation; for cryptocurrencies, it is the functionality of the blockchain and its use cases. The problems a blockchain solves and the population which adopts it (or will adopt it) is enough to drive the value to the moon or to the mud, regardless of how it is been generated, the amount in circulation, or how it is been distributed.

Developing a good use case for a blockchain project and working towards building a flexible blockchain that achieves this is the master key to a valuable blockchain token. A good generation and distribution scheme adds even more taste to this. A good example is bitcoin which sits first in the capitalization rankings with just over eighteen (18) million tokens in circulation.

Viability and the overall reputation of the project

How active a project is and the reputation of the project, the community or team behind it, affects the value of its tokens notably. The XRP army or the bitcoin maximalists? these are two very popular communities in the crypto space. The role they played/are playing in driving the value of their associated cryptocurrencies rings a bell across the crypto space.

A community standing behind a project and propelling its success has proved to be of value over the years. A good tokenomics practice may include building a great community around a project. However, this cannot be achieved without at least a promise of a potential good utility for the token.

This promise backed up with visible proof of hardwork from the team towards achieving this goal and also sincerity and transparency from the team is the first step towards attracting a good user base. The user base builds the community, and continued dedication and good practices by the team grow this support and solidifies the stance of the community on the project.

Considering a project’s tokenomics as an investor/enthusiast

.

The crypto space has a very dynamic atmosphere, with new projects springing up frequently and existing ones striving to gain ground in this very competitive industry. Each project comes in with a new concept and a proposal that aims to solve an issue. Written carefully in their whitepapers are plans and road maps towards achieving this stated goal. Each paragraph comes with a promise and a vision.

Despite these promises and carefully crafted proposals, a higher percentage of new projects fail. Most existing projects are merely struggling to retain their investors, stay in the game and make progress. This is always below the expectations of the investors who are compelled to invest in these projects because of the visions…and promises.

Each project which fails to live up to its promises incurs grave losses on the investors and drums home the importance of careful investigation prior to investment. Taking a deep look at the tokenomics of a cryptocurrency project cannot be over-emphasized.

A project which fails to present a feasible use case and a flexible functionality is a huge gamble. Having a good branding, token generation and distribution scheme may appeal to the shallow view of investors. For a clever investor, a shallow view appeal should be a mere attraction. A closer look at the feasibility of the proposals and the abilities of the project team is paramount to building trust and making careful investments.