Two contrasting messages; “cryptocurrencies are the best-performing assets in the past decade” and “cryptocurrency investments are Risky!”. Same topic, different assertions, both of them correct. While many have made life-changing wealth through cryptocurrency investments, a lot more have a very different story to tell. While I’m not an advocate of cryptocurrency investment as just a ‘money-making’ scheme, losing out on any investment isn’t pleasant regardless.

Came for the technology, stayed for the money…and vice versa. The majority of participants in this space are clearly interested in cryptocurrency investments’ ability to generate mind-blowing returns in a very short period of time. Those 500% gains in 48hrs aren’t something you see anywhere else; in crypto, it happened very frequently. I mean, who wouldn’t want to turn $8,000 into 5 billion dollars in just a few months?

But more frequently than not, investors suffer huge losses on their cryptocurrency investments. This is partly due to the volatility of cryptocurrency prices; investors have a share of the blame anyways. Stepping into a space like this, the first thing to note is the fact that everything is time-bound. Price rises for a while, it also falls for a while…even your influencers’ shill tweets don’t last forever; it takes a dump to get them deleted.

Well, that’s by the way. It’s exciting to be in a space where constant fluctuation is a norm, it’s the volatility that makes the money, and drains it too. Playing safe is a virtue. Going all in could work; but most times, the story is different. Even when you have invested ‘what you can lose’, it’s still unpleasant to see it crash. In this space, crashes are usual…and harsh.

Informed investing could save you a lot.

One popular mistake is ‘chasing pumps’. It’s human nature to chase trends and the fear of missing out is a huge drive. Investors rush to these hot shots with hopes of reaping from the next possible gains.

This works, sometimes. It’s an uncertain market anyways and anything is possible, but being a successful investor hardly comes from jumping on trends. 50% gains, the rush kicks in. Speculators take the space and the project in question gets mentioned everywhere. The trend goes on, enthusiasts buy in with only a little idea of what the project is really about.

TA analyses, hypes from influencers, gains on trading pairs…these things are enough to sweep anyone off their feet. But regardless of how hot the hype blows, clever investors will certainly do their own research before buying in.

In profits, you should take some

Cryptocurrency’s volatility means an investor could make crazy gains in a very short while. 5X, 10X…these are huge returns; in crypto, they are in fact meager returns and happen very often. Well, they could also go either way at the same pace.

Filled with expectations of even crazier gains in the near future, an investor who already made tangible gains is caught in a dilemma. Cryptocurrency markets are fast-moving, double-digit price drops could happen in a blink of an eye, but selling after some ‘little’ gains might be too early. Despite having hit the initial target, things still look promising.

“This could be a life-changing opportunity”…investors usually have these words running through their mind as the project they invested in continue to look healthier and promising, even after making some crazy gains already. Greed sets in — normal human behavior.

To take profits or to continue holding? Any investor would find it hard to decide, especially when you are just a few steps away from hitting your target.

Take a time to consider some conditions that are personal to you. What was your initial target? Over everything, why did you make this investment in the first place? To pay off your rent or to fix some debts? Probably a very different reason, but the level of importance is best known to you.

Imagine waking up to a 30% drop? Jaw-dropping! It could be the other way around. But either way, what are the chances that you will take this event with your head held high? In a situation where you already hit your target but decided to hold on for a little while but things quickly go south. The regrets are huge, but are relative and could vary depending on the investor and the condition.

Nevertheless, it still hurts to see the project you were invested in making crazy gains after you have sold off your investment. The sideways movement constitutes this dilemma.

With this in mind, selling off your bags at once is a bad idea. Selling them in parts at different targets is probably a better approach. Thing is, selling in parts at different targets might mean you get out of the market with less; but if the price continued to go up, you’ll leave the market with more than you would have if you sold at your first target. If the price drops after you sold a part at your first target; you’ll leave with lesser, but the loss is tamed.

Dealing with the ‘Winter’

Every cryptocurrency investor wants the chart to stay green and never red; at least, until they get to their target and sell-off. Only a few realize that the path to their target is filled with trials and tribulations. Now I said that the religious way, lol. If you’re wondering; I’m one of those investors who want the greens to prevail at all times. I mean, who doesn’t? well, only the guy waiting to ‘buy at a discount

Nevertheless; dips are inevitable, regardless. The chart goes red whenever a holder decides to exit the market, partially or completely. The extent of the dip depends on how many people exit the market and how much control they have over the distribution. This is the main reason why whale movements are studied and dreaded. A whale exiting the market could shake it badly, and the market could ‘tank’ depending on the whale’s holdings.

Dips are not only ridiculous, but they are also (very) poisonous. Cryptocurrency dips are sinister; not only are they sudden, but sometimes they are wild. 20% loss within 20 minutes. It happens faster than that most times, everything a cryptocurrency investor dreads. Well, you were warned. This space is more volatile than chemistry lessons. Poor comparison if you ask me.

For intending investors, the dip time is usually the best time to buy. Maybe the coin is just pulling the strings and you know…as the saying goes, ‘it always shines after the dark’. So, if it’s dip time, then it’s buy time…but that’s not always the case.

The normal idea is always to buy the dip and hopes it doesn’t dip further from your purchase price. Moves like this have come out good sometimes, however many times, the current dip point is just the tip of the iceberg as more dip comes after the initial dip and leaves those who bought the initial dip at loss. Ready to buy the dip? Maybe you should give it a little thought and invest some time in making a little research.

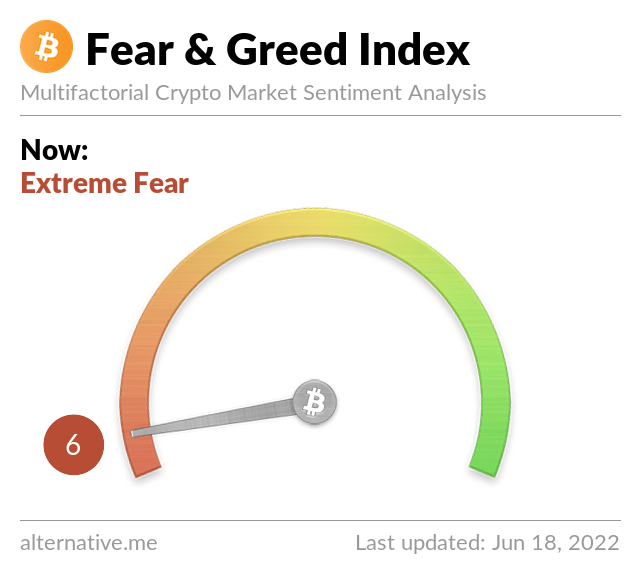

It is very important to study the events which resulted in this sudden slash in price. Getting greedy when others are fearful is unarguably a good move, but sometimes this could also backfire, in reality, this move is always risky. Taking time to make certain considerations before ‘getting greedy’ increases your chances of averting some disasters. Price may dip badly in cases of irregular acts by the team behind the project you are invested in, this always drives the price nuts and could possibly dip to its last point, I mean, the team is gone!

Investing in what you can lose doesn’t mean you should actually lose them; it means you should try and make the most out of them. Making the most out of your cryptocurrency investment takes a level of carefulness and bold moves too. Playing safe should be considered at (all) times.