Three big cryptocurrency exchanges pumped literal millions into the super bowl to have their commercials aired during the prestigious event’s commercial breaks. Not so big when you consider the fact that two of these exchanges are buying up the naming rights for prestigious American sports centers. Tezos have partnered with the famous English premier league club — Manchester united; at least we are finally seeing that big ICO money come to life.

With arguably the greatest soccer player ever wearing those training kits with ‘Tezos’ written boldly on them and Lebron James getting buckets at the crypto.com arena, one thing comes to mind; “crypto is taking over the world”. From a small group of nerds working on ‘the future of money’ to millions of people holding cryptocurrencies…for mainly an odd reason, cryptocurrency and blockchain have walked a long path in just twelve (12) years.

Twelve years of struggle for relevance; like a stubborn attention seeker, cryptocurrency has snuck its head in every nuke and cranny. From social media to billboards and television commercials; cryptocurrency marketing strategies are almost as brilliant as the technology itself.

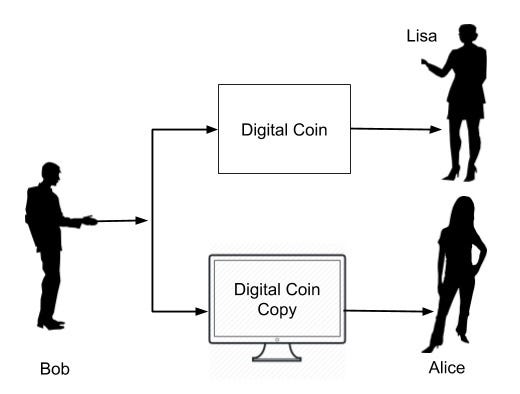

But there is one big lie along the line…

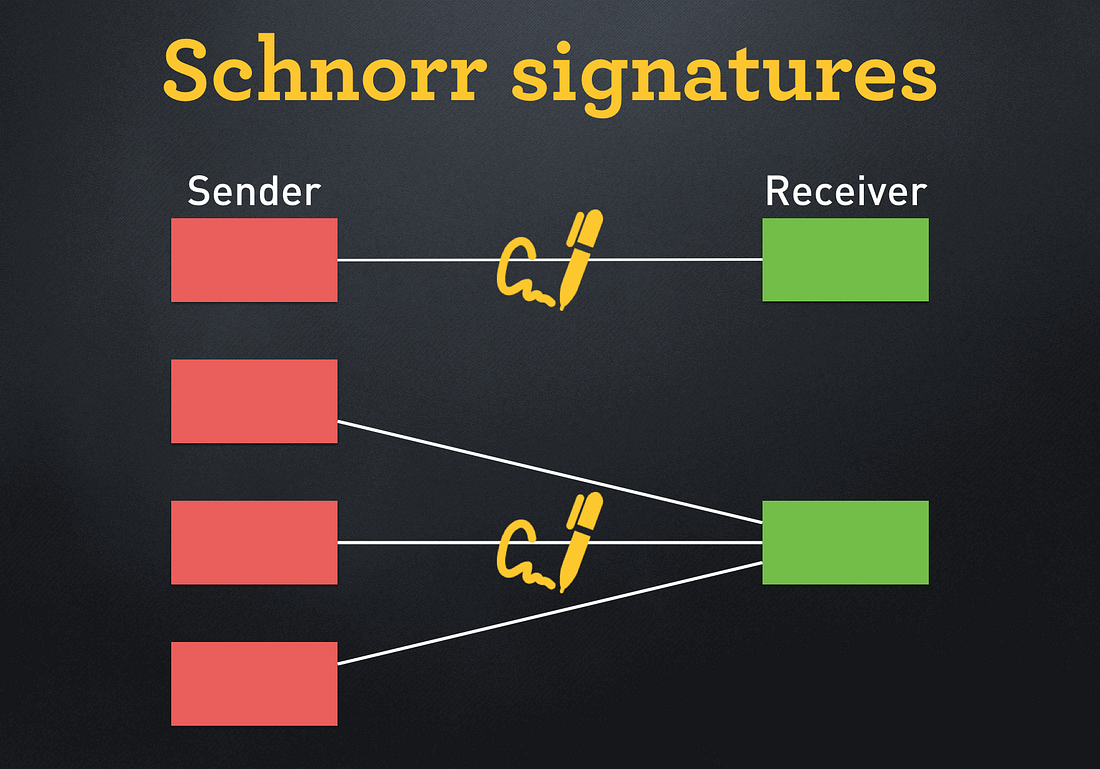

Cryptocurrencies’ are presented as a portable and more convenient means of exchanging value. The biggest perks over traditional alternatives are decentralization and privacy. Speed and transaction cost used to be on the list; not sure if they can be boldly enumerated anymore. It costs over $4 to move Ethereum and about three times more to move smart contract tokens, bitcoin transactions would require similar fees too…

Despite these issues, cryptocurrency’s popularity has been on the climb and isn’t slowing down anytime soon. Bitcoin particularly has seen huge political breakthroughs and has become one of the hottest economic and political topics in the past five years. This relevance isn’t really due to some technological advantages it possesses but mainly due to its tokenomics and mode of operation.

Bitcoin’s distinction over fiat as a store of value is its limited supply. Governments are however reluctant to acknowledge it as a legal tender due to presumed support for illegal financial activities, supply algorithms…and carbon footprint. These reasons are valid, the back and forth on legalization and ban continues. You could anger the Chinese president by simply screaming ‘bitcoin!’.

Bitcoin fits best as a store of value and a payment solution, even though it is currently not very efficient in the latter. Other cryptocurrencies and blockchain projects attempt to solve numerous other problems. Artificial intelligence, oracle solutions, decentralized internet, comedy (yes, comedy!); a number of altcoin projects fit into these categories and more as they attempt to solve more real-world problems and possibly replace existing options. Each of them has earned themselves tons of believers and investors…but again for an odd reason.

When news? “Huge or not”? Investors couldn’t care less about the relevance of any of these projects. Major updates, and (huge) partnerships; regardless of the relevance of these to the actual development of the project, investors fly in with different emotions. Buy the rumor, sell the news; you’ve surely heard that too many times in this space.

If you’re truly here “for the technology”, then you are actually one out of a very scarce few. For a space filled with thousands of very volatile assets and clever marketing strategies, speculators are sure to flock in and tap from the fast-flowing streams.

Getting rich quick is actually the most appealing ability of cryptocurrency.

These adoptions are rarely for the technological advantage cryptocurrencies have over fiat. Even El Salvador has competent plans to redeem their crypto profits in fiat and channel these profits to national development. It’s safe to say that the central American nation didn’t adopt bitcoin because it is a better option to fiat but because in contrast, it is in constant growth in value. This is the same with other institutions adopting blockchain products.

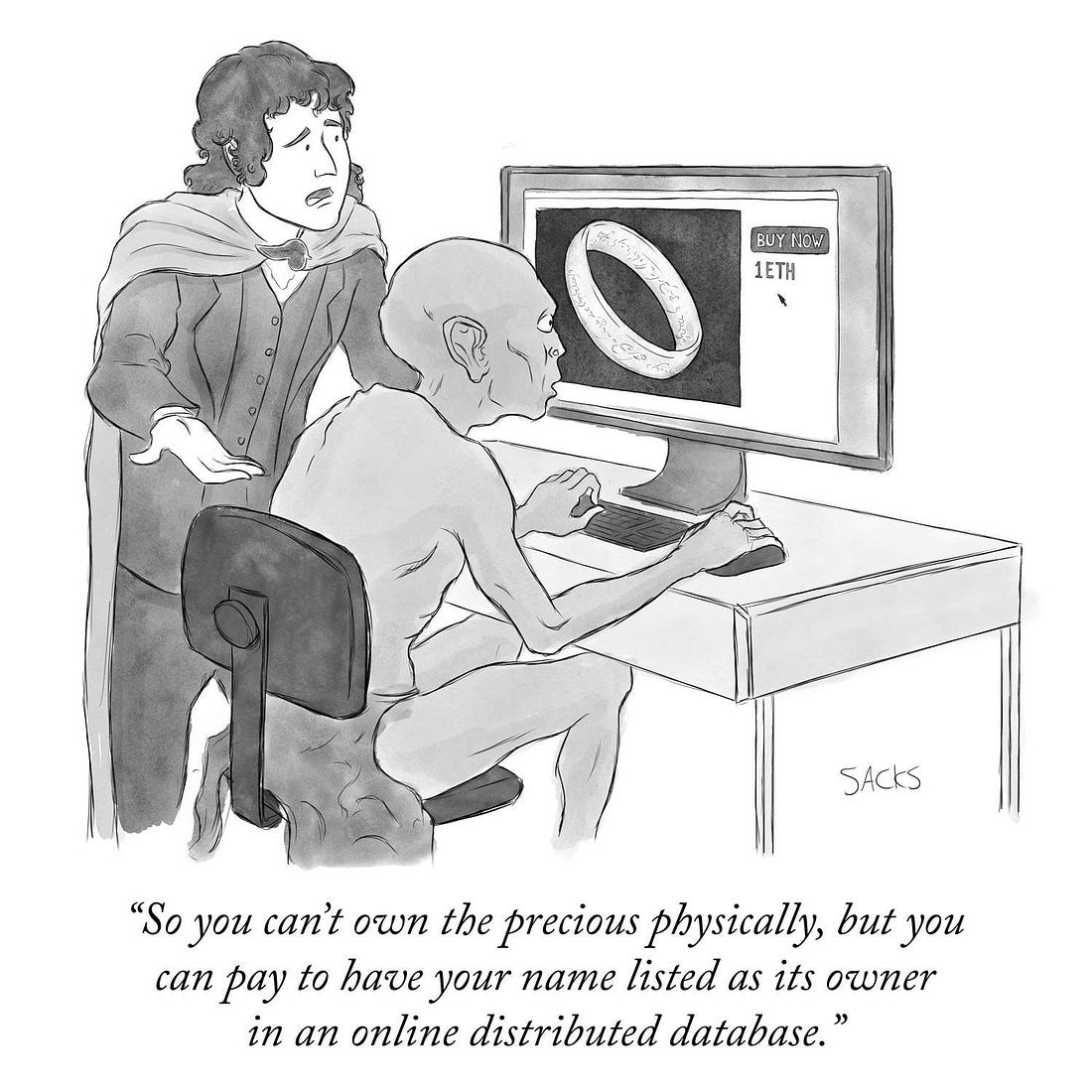

Mainstream celebrities jumping into the NFT trend rarely understand how the technology works and what NFTs really are. Simple process; mint the arts, sell to speculators, and take the loot…in stable coins or actual dollars, lol. How the blockchain actually works and why it is a better option? You can save those long lessons for anyone who cares!

Cryptocurrency adoption comes down to a need for inclusion and the need to be a part of an enriching ecosystem. Very different from the reason presented in our thoughts.

The big lie is, cryptocurrencies are not adopted for technological advantages, and neither is blockchain technology. NFTs are shiny and popular brands are seeing them as a major avenue to improve their financial conditions. Celebrities dishing out NFTs and chasing out in stablecoins and dollars is the most crypto thing you’d ever see.

Companies too are finding ways to include a two trillion dollar opportunity into their purchasing option. The inclusion of crypto payment options into commercial platforms comes as a result of this. Firms looking to expand their purchasing power include the crypto payment as a good marketing strategy. It will be interesting to see the percentage of these merchants that keep a majority of the cryptocurrency they realize in their reserves.

Cryptocurrency is reaching out to people, and speculators. Investors are more dedicated participants. A majority of people putting their money on cryptocurrencies are speculators who envision short-term gains and are keen to leverage the enrichment possibilities of the most volatile assets ever.

Shill me the next altcoin to go 10X! worry less about what they are actually building. It is the normal sequence. Institutional and individual adopters are mainly speculators who consider the technological superiority of cryptocurrency and blockchain. The big lie? It continues.