Alright, I’ll make two guesses; first, you’ve surely spent a whole lot of cryptocurrencies and smart contract tokens and you’d love to have some or all of them back again. Now I don’t just mean transaction fees. I’m personally bad at guessing, but even if I got the first guess wrong; I’m sure about the second. Who wouldn’t want to eat their cake and have it back? Depends on how tasty the cake is!

Well, thanks to some old blockchain tweaks, you could get your tokens back after spending them. And this is not some pro-hack article. Don’t get too excited anyways, this won’t come easy…if possible, at all.

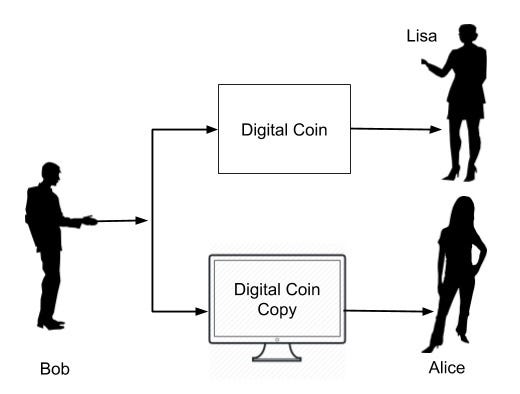

This phenomenon is more properly known as Double spending.

During blockchain’s earliest days, developers argued the possibility of a user interrupting the network to revert their expenses. This was a possibility. Satoshi’s initial presentation of bitcoin via the bitcoin whitepaper featured plans to prevent double-spending using digital signatures and a peer-to-peer network.

We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.

Double spending is the possibility to interrupt the normal flow of information on the blockchain to enable a user to regain previously spent cryptocurrencies.

The blockchain is literally a ‘chain of blocks’. Each new block is linked to the previous block and identified using a unique hash. The latest block represents the current state of the blockchain and carries every recent information including wallet balances. If certain conditions are met, the blockchain could be intercepted and the current block modified or changed completely. This modification can enable someone to reclaim already spent assets.

For someone to double spend, a secret block has to be mined that outpaces the creation of the real blockchain. They would then need to introduce that chain to the network before it caught up — if this happened, then the network would recognize it as the latest set of blocks and add it to the chain. The person that did this could then give themselves back any cryptocurrency they had spent and use it again.

Investopedia

The blockchain design ultimately limits the risk of a double spending attack happening. With the distributed control of the network to the miners, executing a double spend attack becomes hard and nearly impossible…depending on how guarded the network is. Blockchain networks like bitcoin and Ethereum with a large number of miners with varying computing powers will be relatively harder to breach. Each block is screened by miners before they are confirmed and added to the blockchain. Bad blocks are screened out in the process. Sneaking in a secret block will be a tough task on well-decentralized blockchains.

Double spending attacks are much likened to 51% attacks. The attacker will need to control at least 51% of the total computing power of the network to execute a double-spend attack on the network in a proof-of-work blockchain. Similarly, the attacker will need to control over 50% of the staked token supply to execute a double-spend attack on a proof-of-stake blockchain.

Lots of big words thrown around already. You’re probably just here to learn how to retrieve those sold coins and sell them again. Well, that’s simple enough…at least you have an idea of how to go about it now. No jokes though but while the distributed ledger technology makes double-spend attacks hard, there have been reports of attempts to launch this attack on certain blockchains.

Leave a Reply