You know those ‘zero to crypto rich’ stories? Yeah, they are very common in the crypto space. A couple of them are obviously bloated and there’s more to the story. Growing your portfolio is not rocket science anyways and through clever strategies, one can go from zero to ‘crypto rich’. How fast this happens is, however, dependent on a number of factors without one point of control.

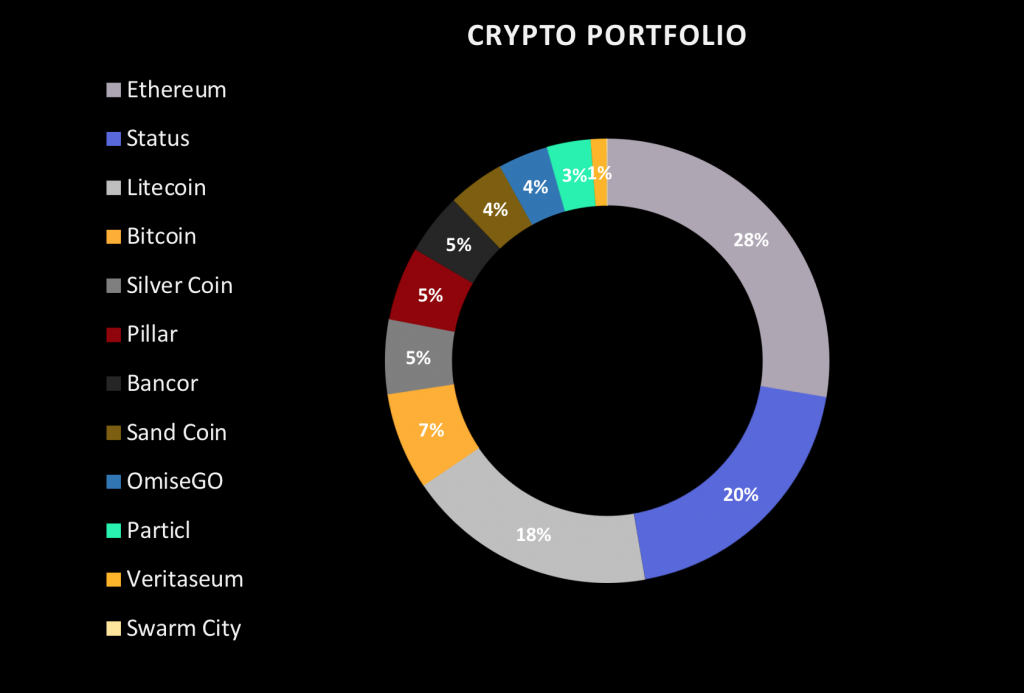

Whether you’re here for the technology or for the ‘riches’; one thing for sure is; you’ll surely be gladdened by an improved position in the few projects you’re invested in. Regardless of how much you wish to diversify your portfolio, missing out on tons of brilliant projects is inevitable. Well, you only need to get it right with your few investments. Over-diversification hasn’t really worked anyways.

First, a start, then improvements and growth. The first step is to make your move into the crypto space. You’ll be amazed by the number of enticing projects that greets you. Depending on factors personal to you, you can only invest in just a few of them.

And do you really need capital to start? If you consider time as an important resource, then yes. Else, time and dedication are all it takes to make a head start.

Financially buoyant investors can simply go ahead to seed cash on any crypto that impresses them enough; otherwise, here are four tips to grow your cryptocurrency portfolio with little or no capital.

Invest your skill and knowledge.

Unlike more other investment spheres, the crypto space is home to unimaginable opportunities. Like a world of its own, there’s room for almost anything and anyone. One way to hasten your growth is to get involved. Putting your skills to work can avail you of opportunities to earn even more cryptocurrencies. From crypto-earning blogging platforms like hive, steem, and publish0x to freelancing and full-time opportunities. It’s a whole new zone, you should explore and improve your positions at the same time.

Airdrops can be life-changing.

Apart from the infamous lucrative DAO airdrops, cryptocurrency airdrops might seem uninteresting to most. $20 worth of tokens as a reward for performing a basket of social activities. Before airdrops became ‘free’ and instantly life-changing, this was the state of things. But this kind of airdrop can still be worthwhile regardless. The majority of them fail to make it out, but in some cases, they grow to very profitable heights. Participating in ‘promising’ airdrops is something you should consider giving a try.

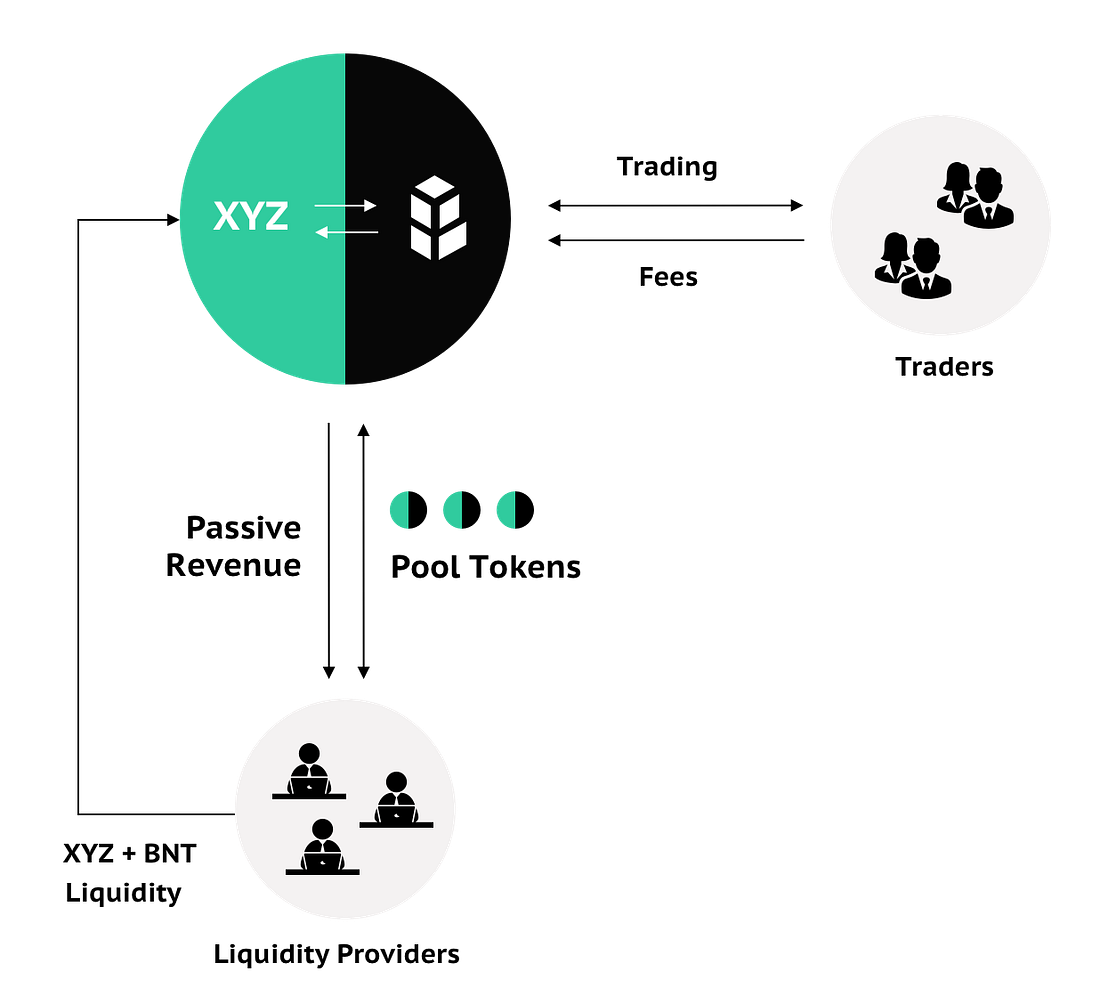

Embrace passive income opportunities.

Leaving your tokens in your wallet is a safe practice, but for someone looking to grow their stakes, this, in fact, defeats the goal. Most cryptocurrency projects give holders a chance to benefit from the emissions and grow their stash regardless of the price. Staking programs and liquidity mining are popular passive income opportunities in cryptocurrency and DeFi. At least one of these is worth a try. Decide which passive income opportunity is best suited for you and put your investments to work. Cryptocurrency lending platforms are also good passive income opportunities.

Preserve your capital.

Risk management is also an essential skill. Cryptocurrency prices are prone to rapid fluctuations, accidents are common too. Ensuring that you don’t run into grave losses is important. As a micro investor with a ‘small bag’, your risk threshold is very little and any tangible loss is a huge setback. Try and preserve your profit and be slow to take uncalculated risks.

Your route to cryptocurrency wealth will be well simplified by following these pretty easy tips. Human behavior is somewhat erratic and cryptocurrency itself is hardly predictable, varying conditions might make it hard to adhere to some of these. Most importantly, always do your research.