Polygon had a Bullrun type of move over the past week, they’ve got a lot going on and the market reflects that. Nailwal and his team are obviously killing it. At least, Paulo and his Tether team now have a new platform to print the ‘all important’ USDT. Not trying to throw shades…just stating the obvious. In the middle of a strong bull run; that move was quite impressive, but it wasn’t without a trigger. Polygon had announced an announcement.

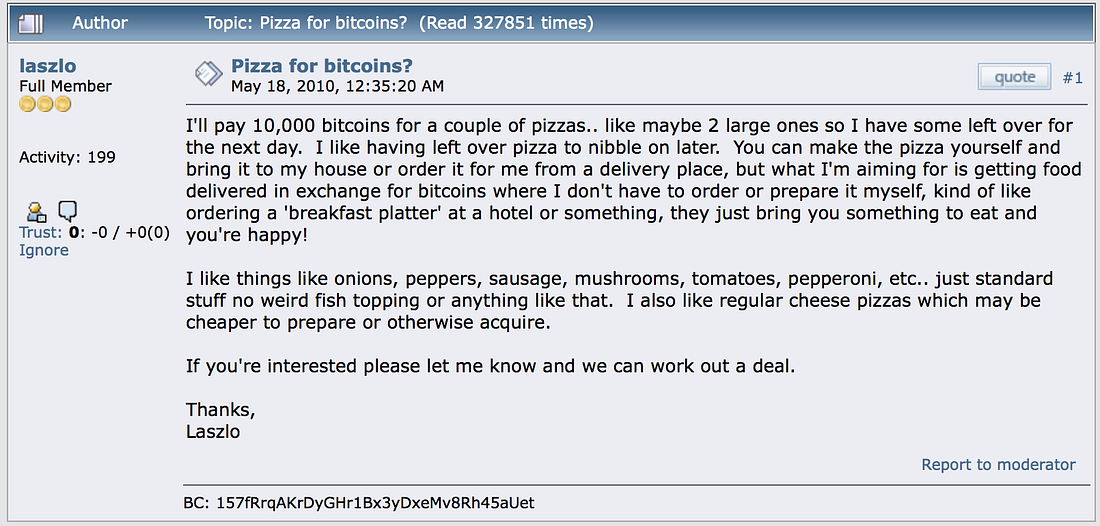

Well, cut the wait…if you did wait at all. Polygon is launching a scaling solution for Ethereum. Ethereum’s inability to scale has turned out to be a good business itself. A handful of projects only exist because you might have to pay over $20 to execute a smart contract transaction on Ethereum mainnet, and sometimes more…or less. Optimism, Arbitrum, Binance smart chain, Fantom opera chain, Avalanche, and Polygon itself; you’ll be making up a huge list if you attempt to mention every multi-billion-dollar projects that are relevant because Ethereum is slow, heavy…and boring. The mainnet itself might not scale anytime soon, but these fixes and alternatives are somewhat more efficient. Fast and cheap; the common features.

One other thing in common; they sacrifice decentralization and security. The blockchain trilemma. When some of these cross chains aren’t halted by the validators, they are incredibly fast and could execute smart contract transactions for a few cents. The constant on-chain mishaps and halts defeat the goal of sovereignty and decentralization. Polygon’s Zero-knowledge Ethereum virtual machine (ZKEVM) will leverage layer-2 technology to develop an efficient scaling solution for Ethereum that maintains Ethereum blockchain-level security.

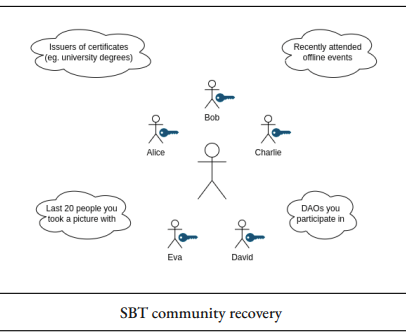

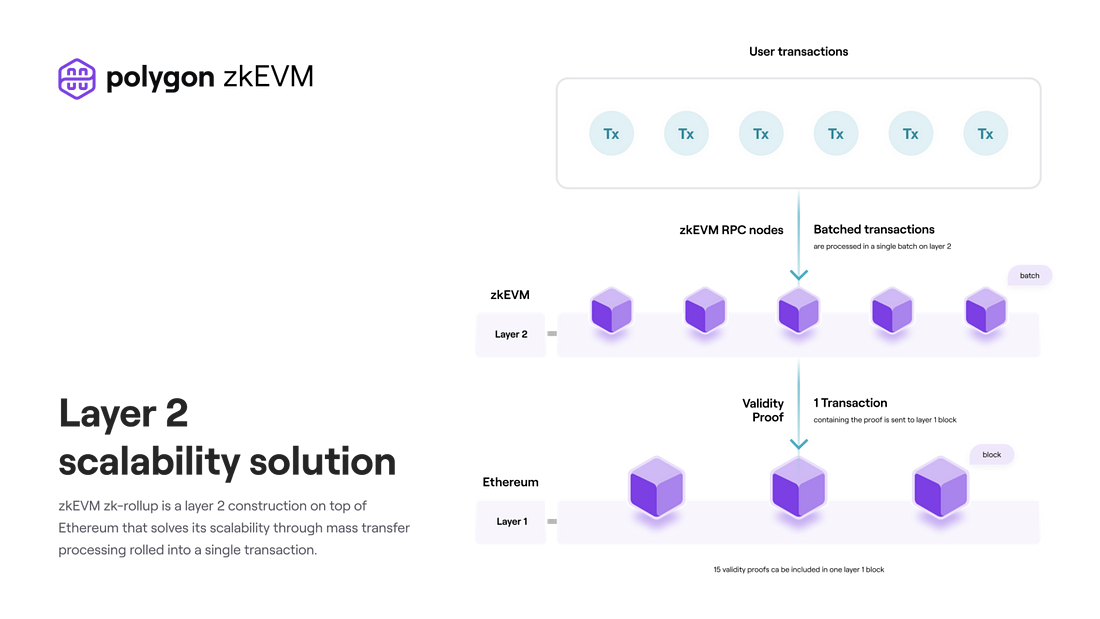

Layer-2 scaling solution is a collection of infrastructures designed to take the bulk of your activities on the Ethereum blockchain away from the main net. Moving away from the main net and utilizing scalability infrastructures gives projects built on layer-2 certain clear-cut advantages.

Leveraging cleverly built resources, Layer-2 projects are building sustainable facilities on the decentralized layer of the most used and innovative blockchain to date. This fast-growing space is welcoming completely new projects as well as existing projects delving into the second layer to build a more efficient version of their products.

ZKRollup speeds up smart-contract transactions and offers a cheaper transaction cost by mass validating transactions. Transaction validation is hence simplified and facilitated as a huge number of transactions are validated at once. ZK-Rollups play the ‘exit game’ ingeniously and perfect the shift from Ethereum’s congested layer-1 while ensuring better functionality than the closely related ‘optimistic rollups’.

We knew that Ethereum needed to scale. We knew that ZK Proofs were the best way to do so. We knew that EVM-equivalence was the secret sauce that would empower both devs and users. So we built Polygon zkEVM, the next giant leap for Ethereum.

Polygon’s ZKEVM is compatible with Ethereum’s Virtual Machine; developers on Ethereum can easily port their projects or build new ones on Polygon’s ZKEVM without necessarily making changes to their codes or having to learn a new coding language. Polygon’s ZKEVM will go live, pending completion of public testing.