Arbitraging is as easy as buying from one end and selling for an assured profit on the other end because the sale point is positively ahead of the purchase point in terms of price development, or lagging as the case may be. Arbitraging is partially the reason why asset prices stay relatively the same across different markets and pairs. Manual arbitragers, arbitrage sniffing bots, and algorithms are lurking on centralized and decentralized exchanges to quickly take advantage of temporal shifts in asset values. Cyclic arbitrage is a common practice in arbitrage trading.

A number of decentralized and centralized arbitrage projects and even projects not directly related to arbitrage trading utilizes the mechanics of cyclic arbitrage to balance their trading system. Cyclic arbitrage could be a really handy theory for cryptocurrency and mainstream trading platforms, even ones that hope to develop an extra income opportunity for themselves.

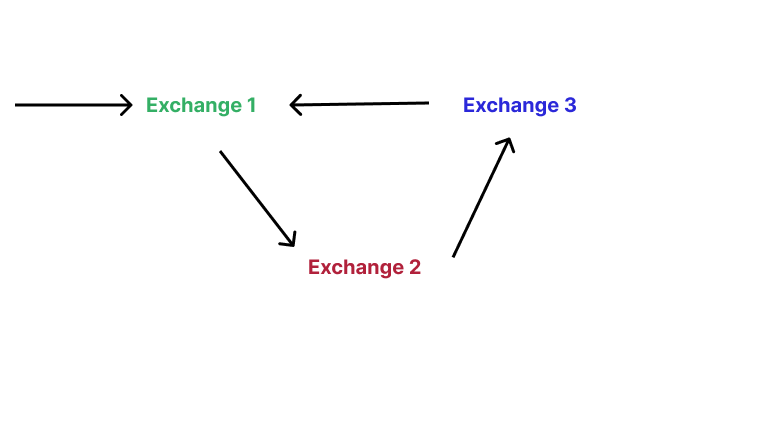

Here’s the basic theory of cyclic arbitrage: The arbitrage trading algorithm sniffs three different exchanges or more with a special focus on a single asset. It collates the current trading price on these exchanges and compares them with respect to their pairs. Using information garnered this way, it simultaneously trades the asset in such a way that it yields a net profit, trades might end up with a different asset, but this asset must have an instantly redeemable value that is above the starting capital.

Protocols that use (or attempt to use) this theory, develop a trading bot that automates it trading in accordance with this theory. Depending on the design of the algorithm, this process is repeated as many times as possible, wither in the same direction as long as the trade remains profitable in a different and more yielding direction.

Here’s a scenario. Say the arbitrage bot detects a difference between the trading price of MATIC on Binance and Huobi with the price on Binance lower than that on Huobi. The bot detects a third exchange (say Kucoin) on which a MATIC pair (like MATIC/FTM) trades below the market value. This bot makes a MATIC purchase on Binance and exchanges the Matic purchased on Binance for FTM on Kucoin. To complete the cycle, it sells this FTM on Huobi for MATIC and realizes more profits in MATIC.

Cyclic arbitrage accumulates the profits from arbitrage trading as opposed to regular one-directional arbitrage trading. Further applications of the cyclic arbitrage trading algorithm will reveal more details about how it works.

Follow up with CRYPTOCURRENCY SCRIPTS to stay refreshed in the crypto space with comprehensive articles and important tips.

Leave a Reply