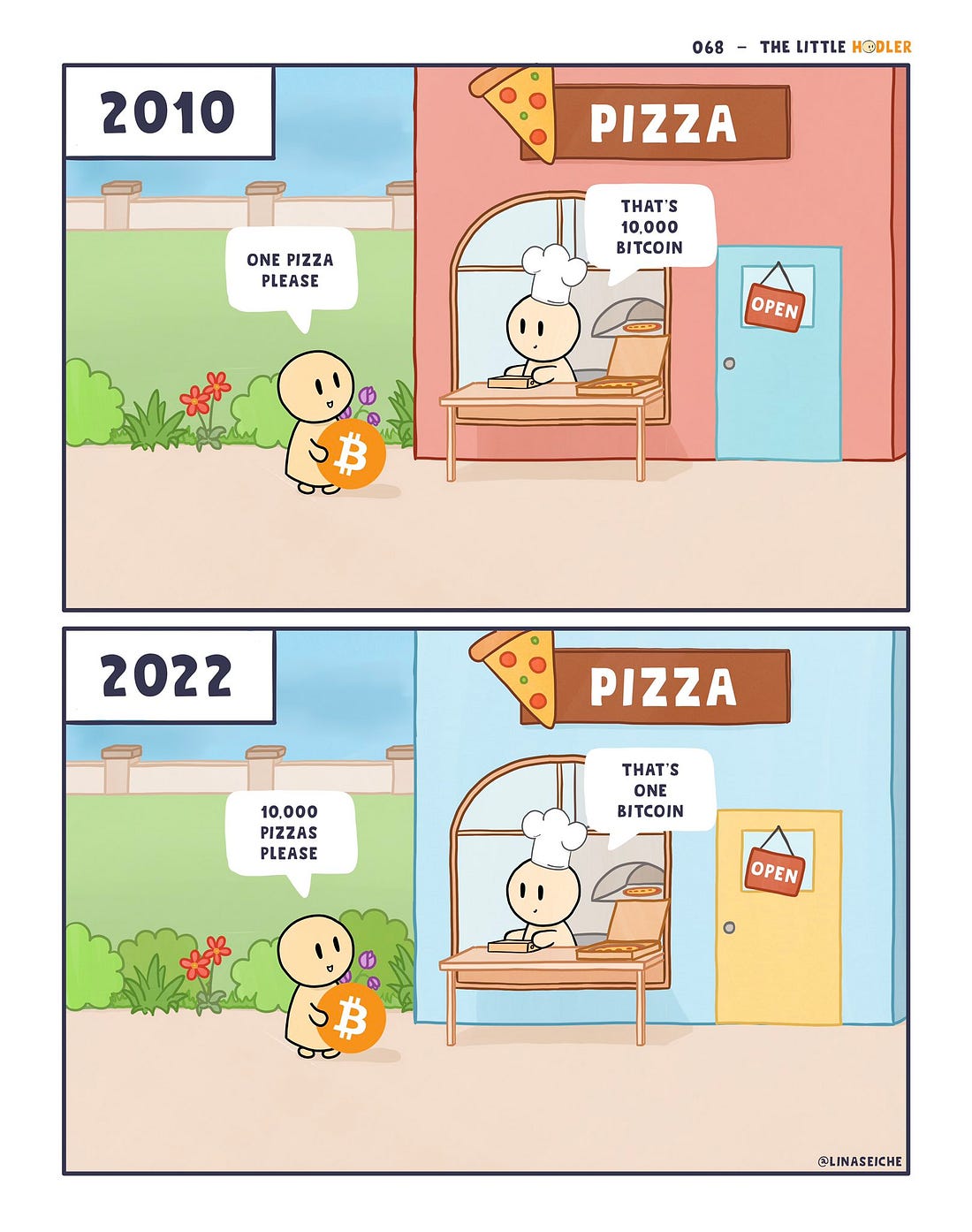

“Your last chance to buy bitcoin at $30K” may sound like a failed prediction, but on a second and deeper thought, your favorite influencer and ‘trader’ might be right. Judging from recent events, bitcoin at 30k is a huge target and is growing further every day. “Plan B” might have gotten his $100,000 bitcoin prediction wrong, but he’ll have more issues if he actually followed his own analysis and bought through them. Most influencers are too clever to follow their own predictions anyways. No jibe about his brilliance anyways, his analyses are still reasonable. Unfortunately, the crypto market hardly follows ‘fundamentals’

Bitcoin was close to some historic values. $69,000 would have been an orgasmic figure, things like that don’t happen too often…naturally. A slow and rather disappointing regression followed; hitting lower points and breaking downward resistances, bitcoin’s off-brake downtrend pulled the rest of the crypto market into a great depression. The bull market looked all synthetic; the market always looked programmed, but this time it was close to obvious. A total market capitalization of $5 trillion was realistic. If bitcoin reached the $100,000 target, that would have been easily possible…

Everyone is a hero in a bull market. Billion-dollar meme coin projects, tons of high-profile airdrops, invincible traders, and ‘rich folks’. The buzz was felt worldwide; Peter Schiff tried to warn everyone and squeeze in his gold superiority arguments along the line. Wasn’t a really good time for him; can’t say the same about the current situation.

Under the flourishing market, a number of projects rose to absolute fame and reveled in bitcoin’s glory to create wealth…and a little bit of utility. Corny developers had their feast and quickly filled the space with tons of projects built in the shortest time by a team of rookies who joined the space when Elon Musk was riding his doge to the moon. Heard he’s got a court case to attend to in that respect. Well, the dogefather went from moon to court, not a bad move…at all. I’m certain he has enough wits to pull that one off, easily.

Elon’s SNL session marked the absolute top for bitcoin and dogeCoin. I’m forever skeptical about the “to the moon” slogan. Things gradually went from bright to dim and the bandwagon of mainstream artists claiming to have adopted blockchain technology quickly began to disperse. Lil Yachty and Soulja Boy made more from their shills than they ever made from jumping in and out of the booth. Making money has never been so easy. ‘Lil Boat’ never bothered to release an album since then. I wouldn’t blame him though, his last one was forgotten too quickly and he certainly has more people listening to his shills than his mumble raps.

Do Kwon at the peak of his wealth might be worth a few billion, but his ego was worth many times that figure. It’s logical anyways, USDC was meant to die by his hands; the reverse was the case but he did put up a good fight. Unfortunately, LUNA investors took all the hit while he was left to worry about a strange knock on his door. The Luna2.0 incentive must have saved him from more strange knocks. Airdrop recipients who managed to sell at launch probably made some of their money back. Can’t say the same about those who held on. The new Luna is 90% down already, and the old Luna…you’ll need a stick to count the zeros. All good, it was fun while it lasted.

A few friends were comfortably living off the returns they got on the bitcoin they locked on Celsius’ lending platform. The temperature quickly got too hot and it was all close to melting. Don’t know the exact degree but somewhere above the boiling point of water. Celsius claimed to be decentralized, but just like my bank, users’ funds were locked when the market conditions became ‘unfavorable’. Alright, they offered more returns than my bank anyways, so I’d still stick to the juicier offer, even if it means risking being liquidated along with the rest of the market.

3AC? A very long story I’d love to skip…

While traders’ and investors’ greed rose to its highest levels; developers’ and project teams’ egos and arrogance also grew to similar levels. You could get the coldest replies for suggesting a fix for some discovered bugs. Who cares about bugs and fixes when prices are going haywire and investors are rugged slowly and swiftly? The big players in the space basked in the health market to fill up their pockets and cared less about the feasibility of their solutions and the sustainability of their strategies.

The real argument is if they had any strategy at all. LUNA and UST’s collapse probably clouded a lot of events, but a few other stablecoins got pretty unstable. Justin Sun mastered the act of following the trend; USDD was basically born in an attempt to bring the Luna sort of price growth to the Tron ecosystem. USDD was in no way an improvement from UST. Just another copy facing the same issue. In Mr. Sun’s case, $600 million is an easier war to fight. USDD stays de-pegged for a number of days now. His Excellency will ultimately do something when his stablecoin gets to the same price as Cardano.

It’s another situation where I find enough reason to justify bitcoin maximalists’ stand on altcoins and any other thing apart from bitcoin. The orange coin’s tragic fall to $17,000 is a result of these irregularities from ‘shitcoin’ projects. that name has never been more proper. Microstrategy will have to bear their losses for now while Elon Musk gets himself a lawyer, there are a few hundred billion on the line. The rest of the space will have to hope we don’t fall into a proper “great depression”