“Bull run comes around once in four years or just after a bitcoin halving”; I have my calendar set to July 2024; but just like my early morning alarms, I’m likely to miss it. Apart from the halving, the 2021 bull run was thought to be triggered by institutional adoption of bitcoin and cryptocurrency…at least that’s what they said. That’s not wrong anyways; Elon Musk dipped some of his Tesla money into bitcoin and spent most hours of his early 2021 days shouting “to the moon”. He’s deep in losses if he still holds on to those bitcoins. I hope DogeCoin is still very much around when his son grows up. He has a huge stash of some Dog coins to inherit…I heard. Not just the rocket man, even Tim cook applauded bitcoin at some point. If there’s anything like ‘Tech leaders’; these two guys should be somewhere up the list with Satoshi Nakamoto and Vitalik Buterin…of course. A worthy mention; Charles Hoskinson; you disagree…I know.

On speculations of institutional adoption of cryptocurrency and blockchain technology, a handful of enterprise-level cryptocurrency projects grew to sky-levels in just six months… or less. Social media did its bit, the hype was many levels above the propaganda. DeFi, GameFi, (and ‘MemeFi’) were the rave. Mark Zuckerberg was destined to have a huge influence on the crypto space. Despite failing with his ambitious Diem project, his Metaverse ambitions have been championed by pump-and-dump cryptocurrency projects. Elon Musk pioneered dog-themed shitcoins; Mark introduced a popular prefix for the next generation of Hype projects. Hats off to Elon though; billion-dollar projects came to life thanks to Dog tags.

For a bull run that was “catalyzed’ by institutional adoption”, even the most innovative cryptocurrencies struggled to make the top search lists in some of the world’s most technologically advanced nations. Bitcoin’s record-setting $67,500 price was just about 3 times its previous record. $100,000 was meant to be a deserved price. That didn’t happen, not when the ‘OGs’ were busy throwing their money on some moon and ‘inu’ tokens and the newbies were struggling to survive the rampant rug pulls. Clean, rinse, repeat; even Hwang Dong-hyuk ‘s Squid game birthed some notable cryptocurrency projects. You can find them languishing in almost zero trading volume while their creators make a living off those funds pulled off the rug.

Simply put, the previous bull run was triggered by Greed. No, not ‘institutional investors’. Elon Musk and Jack Dorsey have always been pro-bitcoin and never hid their appreciation for the technology. Micheal Saylor has always channeled that MicroStrategy money into the orange coin and JP Morgan didn’t start talking about cryptocurrencies two years ago. The halving cycle and the institutional investors’ propaganda only triggered human greed which subsequently caused a hurricane of ‘dumb money’ thrown at everything that runs on a blockchain.

Once it runs on a blockchain, then it’s the future. It was that simple, yet funny. Even the blue-chip projects had huge loopholes in their technology and management. But it’s hard to care one bit when you have a moon flight to catch. DogeCoin raced to $0.7 per coin despite over 130 billion coins in circulation. This wasn’t because it “had a better economy than bitcoin” but because this exact statement was made by the richest man on earth and a lifelong fan of the fun token. Calling the tenth biggest cryptocurrency a ‘fun token’ feels odd anyways.

Like a beast unleashed, the whole space ran haywire. Frequent rug pulls couldn’t quench the raging greed from a horde of investors. When one 1000X project crashes, another is born. It only takes one popular influencer or music star and the gains start to roll in.

An almost exact scenario as the 2017 bull run. We thought that won’t repeat itself; it did…even worse. Taking a look at the 2017 raves that were short-lived, 2017 investors had way less greed. Investors were supposed to be more informed with time; turns out this wasn’t the case. The crypto space is a field of emotions; greed being the principal emotion. The ‘Bigger fool’ theory works here; no doubt.

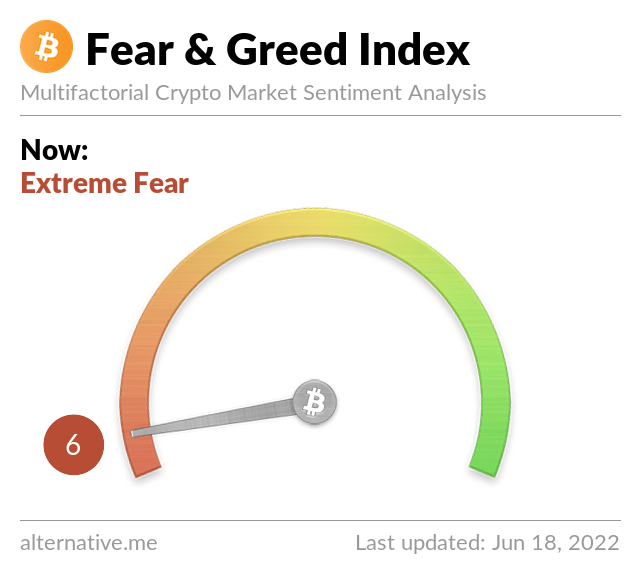

The next bull run? Not sure the exact time that will come, but it will come when there is enough greed. If there are any handy metrics to watch, it’s the greed and fear index; not the halving or institutional investments…if that was ever a thing.

Leave a Reply