Unlike FTX, crypto.com have a reserve that protects your deposits. At least, when they finally file for Bankruptcy sometime in the future, you will get something back for the funds you left on their trading platform. Well, you’ll probably get a couple of million of Shiba Inu, but that’s fine, at least you got something.

It’s been a wild week and just when you think it can’t get worse, you find out that your whole deposit could be sent to the wrong address by the same institution that promises you your funds’ safety. Maybe the banks weren’t as bad as we have painted them over the years. And who cares whether the bank is always open or not? At least they play a better gamble than trading platforms valued in billions of United States dollars.

That’s by the way, I guess the coffee got somewhere between my emotions and my sense of taste. With every exchange showing an undue lack of integrity and bitcoin threatening to go back to 2018 levels, it’s time to deal with some addictions.

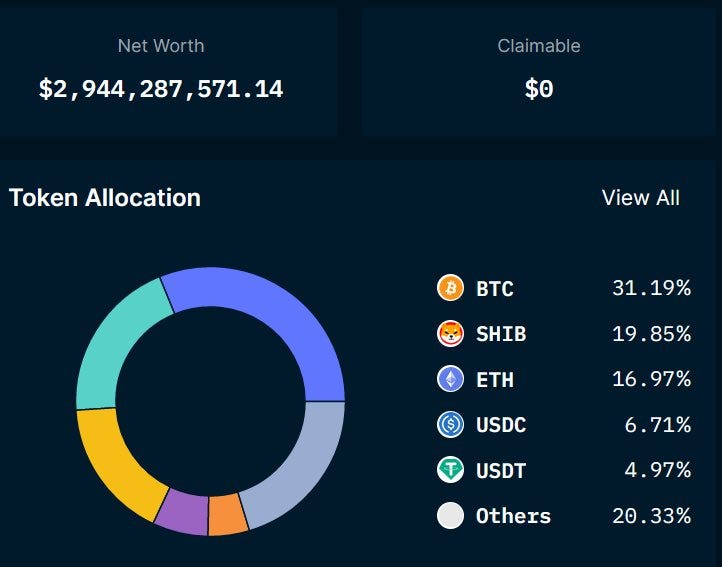

A pitiable state, the whole crypto space. But never mind, the remaining exchanges are proving to you that your crypto deposits are backed by a strong reserve, they are reserved in the most popular meme coins and a little bit of stablecoin and bitcoins as well. Can’t say much about the Ethereum coin in reserves since they can be easily sent to another exchange ‘mistakenly’. One suggestion is to use naming services like ENS and Unstoppable Domains…not sure if billion-dollar companies take advice from a common writer.

I could do a few conspiracy theories, my favorite theory is that all these events are meant to pump Shiba Inu to 1$. Since exchanges have billions of Shiba in reserves, Shiba at $1 will rescue these exchanges from bankruptcy and users can have their funds back while bitcoin races to $200,000 and crypto becomes the global standard of payment and Michael Saylor becomes one of the richest people on earth and the Bankman returns to his Forbes “30 under 30” ranks. I’m very bad at this.

It unfolds like a joke tweet, similar to the one from the Popular Binance CEO, followed by a “Steady Lads” tweet and some storm-calming claims before the -80% drop and bitcoin comes tumbling. It’s sad that the orange coin has to suffer from all these when it has done nothing but stay in the wallets of high-power miners and Central-American nations. Bitcoin is closer to $100 than $100,000; one year ago, it was just a few bucks to $70,000. Funny how everything could change in a year. My favorite coffee brand cost two times more too.

We could go ahead with more puns and sarcasm about how the space has gone from “revolutionary” to a “wild west” it has always been the latter; we were just lost in a wave of “institutional adoption”. I guess we all learned the hard way; apart from the hackers who managed to make a few cash-outs while the market was booming and the projects that successfully rugged their investors. Not to forget the Twitter influencers that earned six figures from simple tweets. I hope they get to pay Mr. Musk his $8 and if they trusted Mr. Fried with any of those funds, then…

For the last paragraph, I will quickly end this so I can move my remaining ERC tokens to my wallet. I will have to pay more in withdrawal fees than the value of the assets, but that’s better than losing it to ‘researchers’ who don’t like using Stop Losses.

Leave a Reply