A successful trade is simply one that takes proper advantage of presiding market conditions. Cryptocurrencies, like any other tradable commodity, are prone to fluctuation in value.

But unlike these assets, cryptocurrencies are susceptible to rapid changes in values and are grossly unpredictable. Making the most out of this volatile market would require strategies and tools that keep you in charge at all times while limiting your losses and maximizing your gains. A stop-limit order is one of those tools.

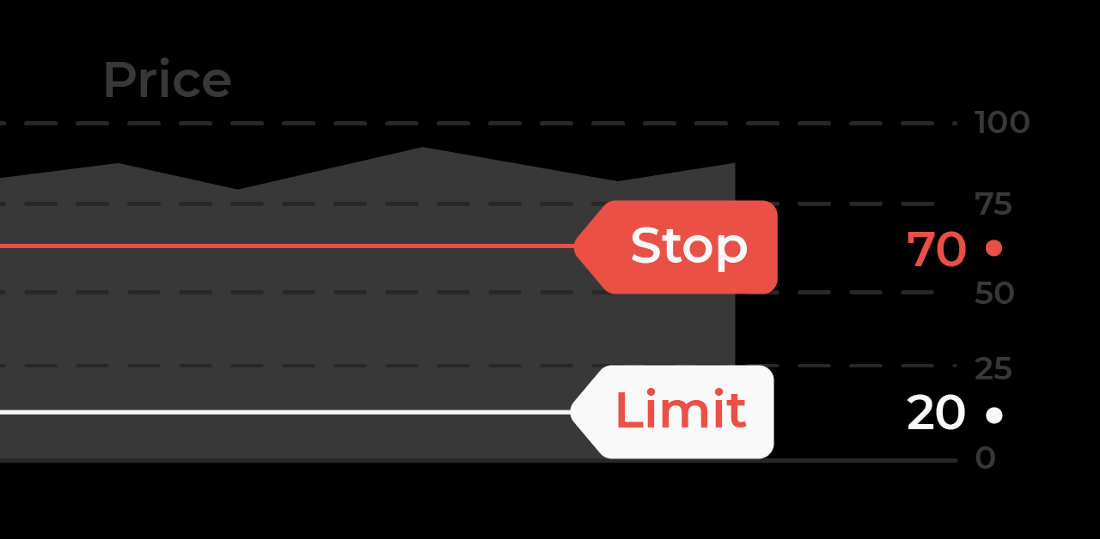

Stop-limit order gives leverage to traders. It allows traders to set the conditions for their trades and automates the execution of the set conditions. Simply put, a Stop-limit order combines a trigger and an execution command. The trigger is the Stop-loss order while the final execution command is the limit order. For better understanding, let’s differentiate these terms;

Stop Loss order

Stop-loss orders are more popularly used by derivatives traders. Stop-loss orders enable traders to limit their losses by setting up a price level at which they automatically sell their assets. If the asset fails to go below this price, the sell order won’t be executed.

Limit order

Using Limit orders, traders can directly set a price at which they wish to sell their assets or buy an asset. Say you wish to buy GateTokens at $3 instead of the current market price, you can simply create a Limit order set to $3. If GateToken trades at $3 or below, your order will be filled.

Understanding the Stop-limit order

To trade cryptocurrency on an exchange, you create an order by setting a price at which you wish to sell your cryptocurrency or buy the desired asset. This order is added to the order book (a collection of others by traders of the same asset pair). When your set conditions are met, your order will be filled if there are enough sell or buy actions to satisfy the magnitude of your order and other orders placed at the same price.

This is known as a Limit order and is usually used in regular spot trading. If your order is set to current market prices (this is known as a Market order), the trade is executed instantly. Only one parameter is set; a buy price or a selling price.

For dedicated traders looking to get the most out of the market, Limit orders are just not enough. The main caveat of limit orders is that they are not designed to take cognizance of market conditions. A stop-limit order is a fix for this shortcoming.

Stop-limit order features a ‘Stop-loss’ algorithm and a Limit-order command. The Stop-loss algorithm works in a similar way as seen in derivatives trading. The Stop-loss algorithm lets you set a condition for your trade. When these conditions are met, the limit order command will be executed.

To better appreciate subsequent parts of this article, a basic understanding of “Resistance”, “Support” and “Trigger price” price is essential.

Resistance: The resistance level is an asset’s price point where the selling interest is highest. The asset’s uptrend is expected to be delayed at this level.

Support: The support level for an asset is the price point at which the asset is thought to have a high buying interest. The asset’s value is expected to remain relatively stable around this level and not go further below

Trigger price: A set price in a stop-limit order above or below which the limit order is added to the order book.

Trading using Stop-limit order

Using the Stop-limit order, traders can set a trigger price, and the direction of their trader when the asset’s price goes below or above the trigger price. When the trigger is activated, their limit order is placed. When the Stop-limit order is set, the trade will be executed automatically if the conditions are met, even if the trader is offline.

An instance for a buy order; a trader who wishes to buy 1000 GateTokens using the Stop-limit order sets a price.

At the trigger price, his limit order is placed. Suppose the trader, through personal analysis, speculates that GateToken will move appreciably after breaking the resistance at $4. In that case, they can set this price as their Trigger order and subsequently place their limit order at a price equal to or greater than $4.

Their trade is thus conditioned to GateToken breaching the $4 barrier. If it fails to break this barrier, the limit order will not be executed. Gate.io also adds a feature that allows you to set the validity of the stop-limit order. The trade is canceled if the trigger condition isn’t met before the validity period.

For a sell order; assuming that a trader bought 1000 GateTokens at $4.2 each and wishes to safeguard themselves from grave losses if GateToken suddenly starts dropping, they can set the trigger price at a determined support price (say $3.9) and also sets a limit order at a price equal or below this price (say $3.6). when the $3.9 support is breached; the limit order is placed at $3.6. If there are enough buy orders at this price, the GateTokens are sold automatically.

Points to consider before using the Stop-limit order.

Stop-limit order was designed to keep you in charge of the market. In perfect conditions, it works excellently. However, this is not always the case and there are certain important considerations to make before using the Stop-limit feature while trading. These points include:

The practicability of set trigger prices

The trigger price feature is meant to allow you to incorporate your analysis of the market into your trade. You can set your trading conditions according to how you understand the market and which direction you think the market will go next. For the stop-limit order to function, these prices must be met. It is important that you consider the probability of your speculations becoming a reality.

Size of your trade and available liquidity

If there are not enough buy or sell orders to fill your limit order, your assets will not get completely sold or bought even when the trigger conditions are met. Do consider the size of your sell or buy order(s) relative to the density of buyers and sellers in the market.

The volatility of the asset

Depending on how fast the asset you are trading swings across price levels, your limit order might not get filled after the trigger conditions are met. This could be due to a wide gap between the trigger price and the limit order. For instance, if your trigger price for GateToken is $4 and the limit order is placed at $4.5, the limit order will not be filled if the price swings between $4 and $4.4.

Conclusion

Stop-limit order gives you an edge, a handy tool for traders. It allows you to stay ahead of situations and retain your control of a market amidst stern volatility. The automated execution of orders serves a double purpose; it gives traders the ability to prepare for speculated conditions and take charge even while they are actively trading. In addition, trading activities are simplified as trades can be executed with less effort; saving time and human resources.

Apart from stop-limit orders failing to execute in certain conditions as stated above, this tool gives traders an undue advantage. It is thus very important to properly study and modify your stop-limit orders to harness the benefits it brings.

Leave a Reply