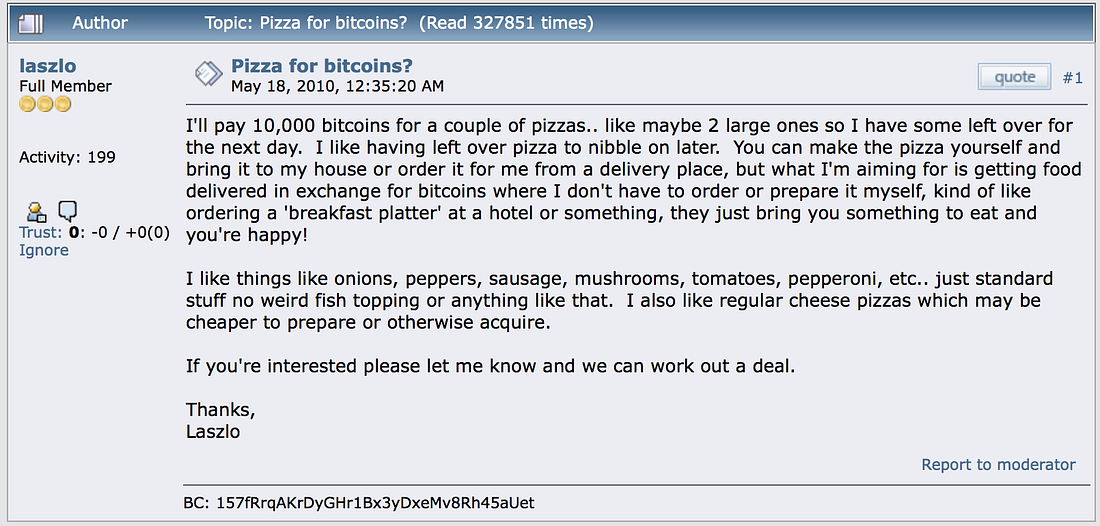

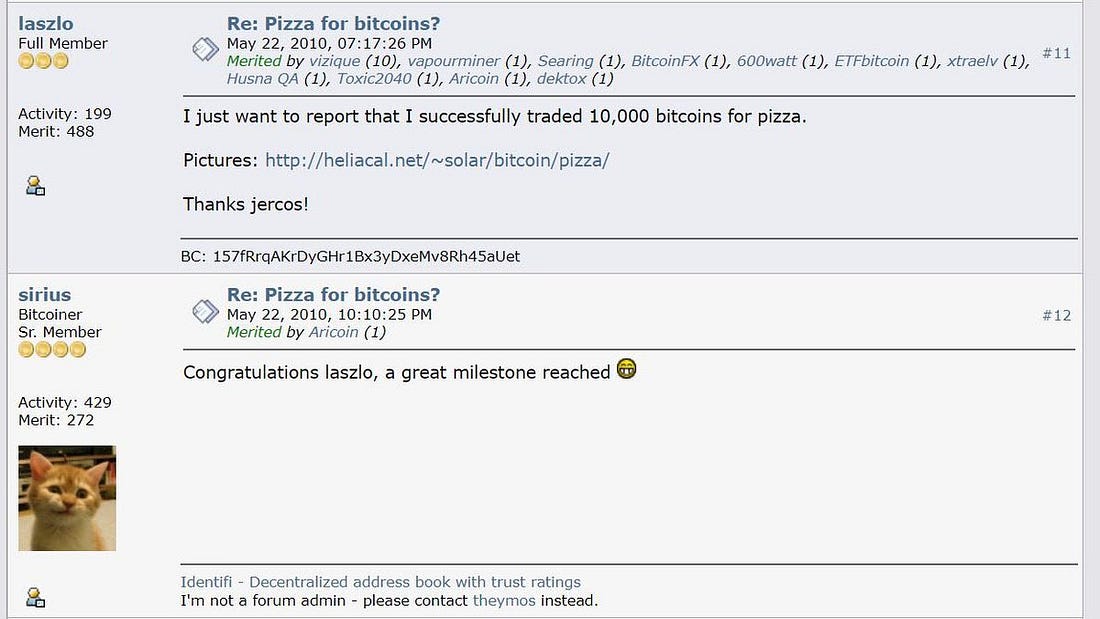

When Satoshi Nakamoto presented the bitcoin whitepaper, (he) envisioned “A purely peer-to-peer version of electronic cash which would allow online payments to be sent directly from one party to another without going through a financial institution.” With his complicated cryptographic breakthrough, he hoped to revolutionize the economy or at least, the financial system.

A simplified payment system controlled by the people and protected by its users; Satoshi’s new cash sounded like an idea from a world outside ours. He kept his identity clandestine, but at this time, only a few really bothered about who really is. He had a vision, but just like his identity; only a few really understood what exactly this goal was.

Like wildfire, bitcoin would grow in popularity and garner interest from developers and finance enthusiasts. Apart from a brilliant peer-to-peer exchange technology, bitcoin’s economy was also argued to score above the current global economy.

“There will ever be twenty-one million bitcoins”

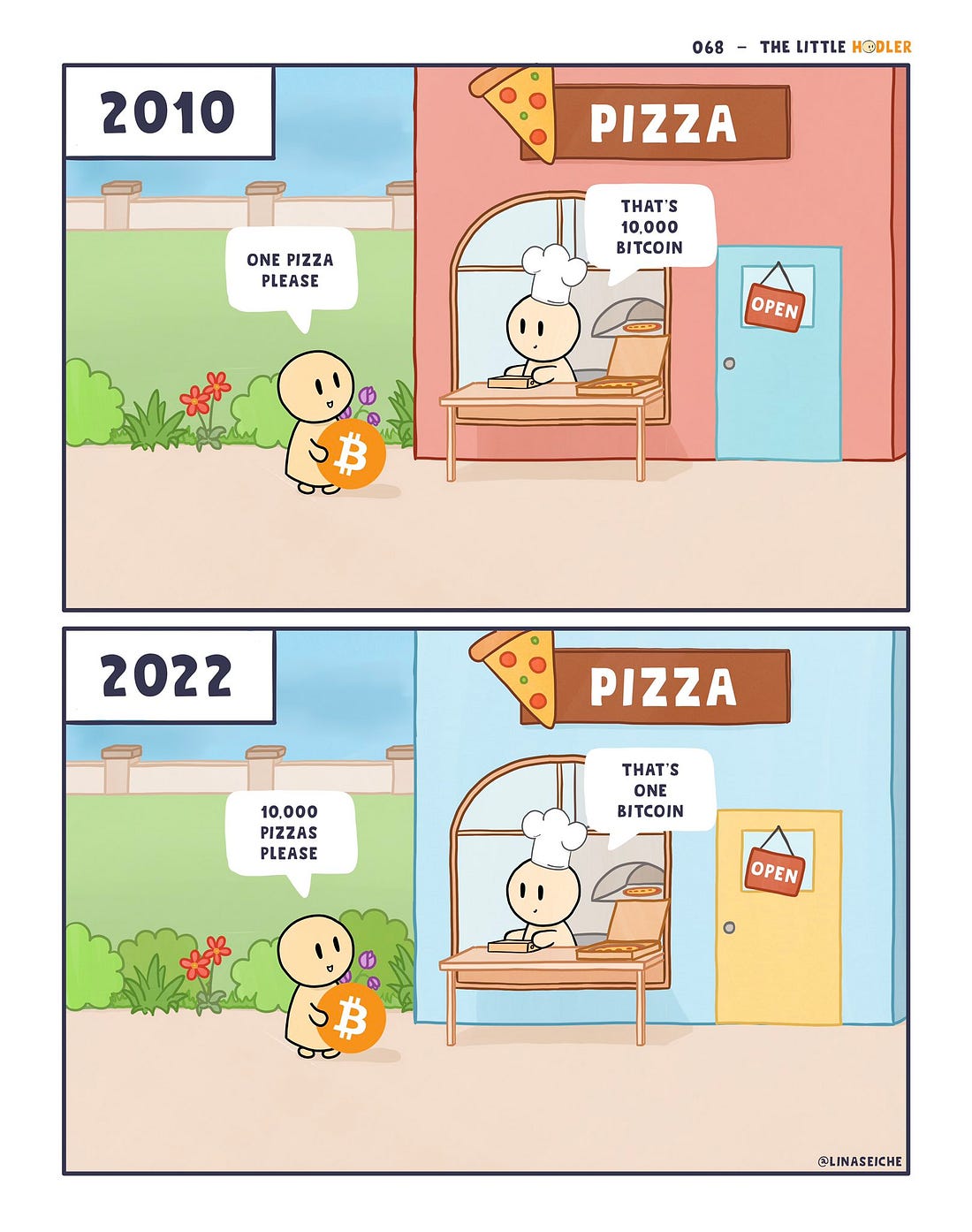

Over a trillion dollars later, bitcoin’s finite supply would emerge as its most marketable quality. Overshadowing censorship resistance and technological efficiency, bitcoin’s original vision ranks below its other features. Basking in bitcoin’s success, the concept which was influenced by Satoshi’s piece of code would grow into an over two trillion dollars worth sector and a space better known with the ability to make investors rich in the shortest period of time.

No matter how much you try to flaunt fundamentals over ‘pumpamentals’; a majority of cryptocurrency enthusiasts are simply here to discover the next 100X and improve their financial status…in fiat. Well, only a few really care about bitcoin anymore. But how impactful has this foregoing been on Satoshis’s vision?

Satoshi’s vision? You might have to repeat those lines from the whitepaper a number of times before any cryptocurrency investor understands it. And when they do, expect them to quickly shove it under the bus. Thing is, it matters very little now.

Sovereignty from the government in almost every monetary activity…the original vision was a currency controlled by the people. The generation, distribution, value system, and expenditure were supposed to be championed by the people. Satoshi, however, couldn’t state the exact role he wanted the government to play here…he probably didn’t care about them; that was the goal, the vision.

How far have we gone? To be fair, Satoshi was slightly over-ambitious. The centralized government has not only grown too strong over the thousands of years the system has existed without tangible challenges. Money on the other hand is their biggest tool of domination and control. With an infinite amount of money at their disposal and an ability to control the value of fiat to an extent, they hold almost total control over the people. A factor Satoshi might have considered before hiding his identity.

The growth of bitcoin has been met with the major involvement of the government. You’d expect them to care a little since the original goal have been abandoned long ago. But yeah, bitcoin and similar technologies are still challenges they have to face and curb to retain their supremacy.

Adopters of this technology have also been overpowered by the tasty option of getting rich by holding volatile digital assets. A very tough temptation. With a lot of ‘new money’ flowing into this space, bitcoin trading over a million dollars is more realistic than Satoshi’s original vision. Investors would prefer this too, or Shiba Inu going to $1 rather.

Whichever comes first; we are already too far from the initial goal and are obviously more comfortable with the financial liberation this space promises; even if it means leaning on governmental approval. An idea this technology was invented to fight.